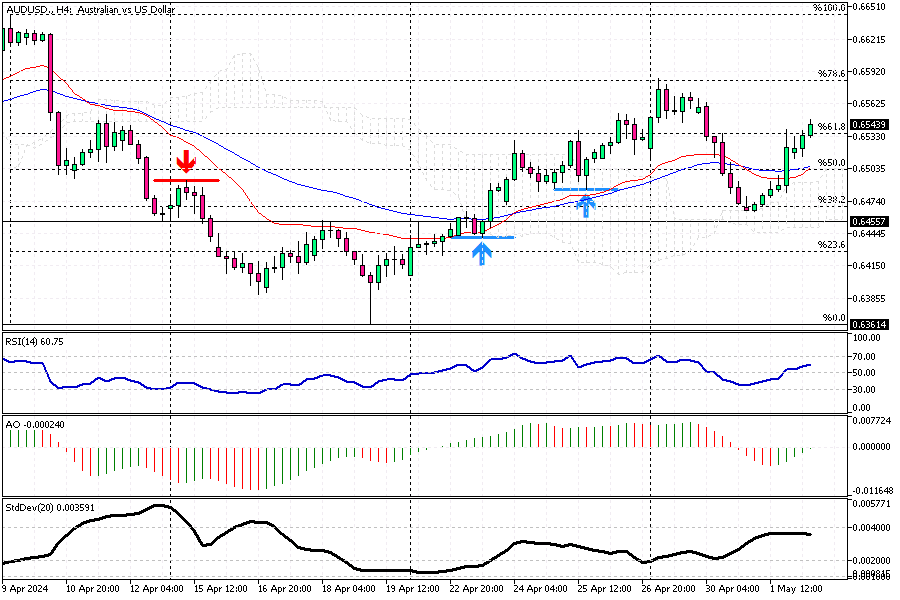

AUDUSD Analysis – Aussie Climbs as Fed Holds Rates

The AUDUSD saw a notable increase, surpassing the 0.654 mark. This rebound comes as a recovery from earlier losses this week, primarily influenced by a retreating US dollar. The shift occurred after the Federal Reserve decided to keep interest rates unchanged. Additionally, Fed Chair Powell dismissed the idea of future rate hikes soon, emphasizing the central bank’s inclination towards easing policies despite some operational delays.

Economic Indicators Affect Investor Sentiment

Recent economic data has influenced market dynamics in Australia. March’s figures revealed Australia recorded its smallest trade surplus over three years. This downturn was due to exports growing at a slower pace compared to imports. Moreover, despite rising demands in the real estate market, building approvals in March increased minimally, indicating ongoing struggles with supply shortages that drive property prices higher.

Upcoming Monetary Policy Decision

Investor focus is now shifting towards the Reserve Bank of Australia’s (RBA) upcoming policy decision. Given the recent re-acceleration in inflation rates, the RBA is anticipated to adopt a more hawkish stance. This expected shift in policy could have significant implications for the Australian economy and its currency, as investors and analysts watch closely for any changes that might affect market trends.