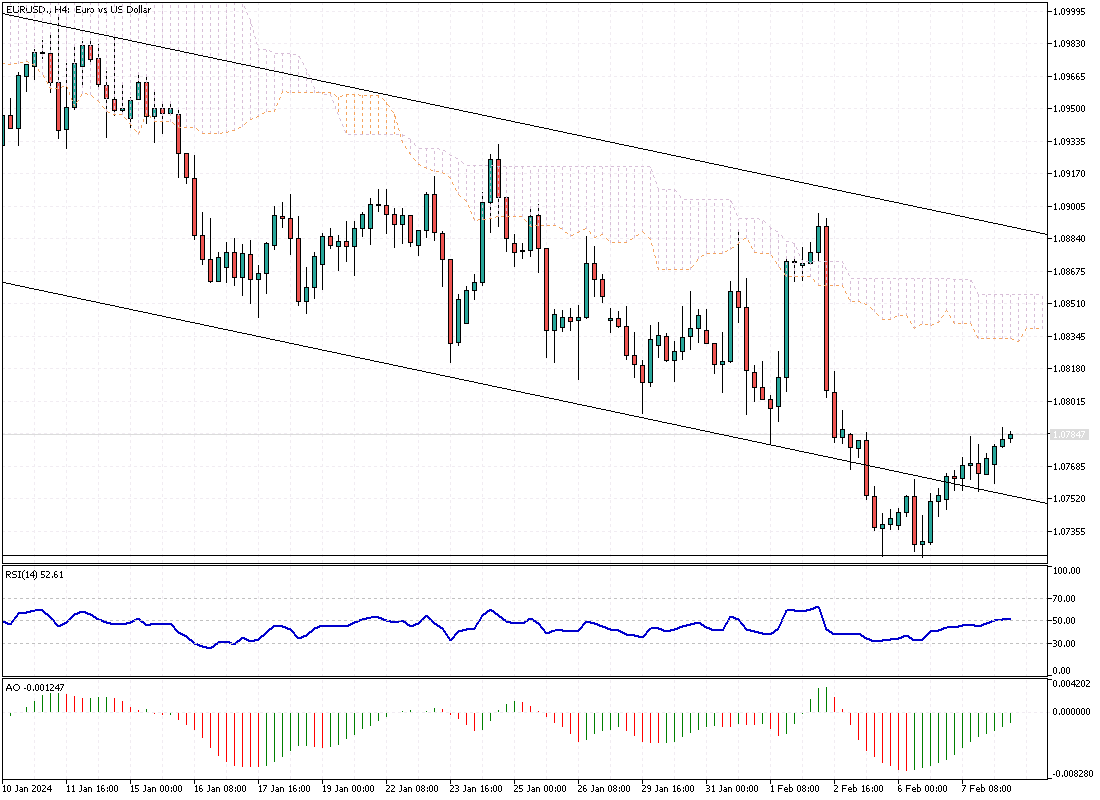

EURUSD Analysis – February-8-2024

EURUSD – The euro has been on a downward slide, dipping below $1.08 to its lowest point since November 13th. This drop comes amid a stronger dollar, as the chance of the US Federal Reserve cutting interest rates soon seems unlikely. While the US is holding back on reducing rates, the European Central Bank (ECB) appears in no rush to ease its monetary policy, even though recent reports show weak economic performance.

Predictions now suggest that the ECB might cut interest rates by about 125 basis points throughout the year, a decrease from the 160 basis points anticipated at January’s end.

Consumer Confidence and Inflation Expectations

Recent surveys conducted by the ECB show a shift in consumer sentiment. Europeans are more optimistic about inflation, expecting it to average around 3.2% over the next year. This anticipated inflation level is the lowest since February 2022, suggesting that people are becoming less worried about rising prices.

However, this newfound confidence doesn’t extend to spending, as December saw the most significant drop in Eurozone retail sales in the last twelve months. Additionally, Germany’s industrial output has been shrinking for four months despite a notable 8.9% jump in factory orders—the most significant increase over three years.

Economic Indicators and Outlook

The economic landscape in the Eurozone is showing mixed signals. On the one hand, the notable rise in German factory orders hints at potential growth and a rebound in industrial activity. On the other hand, the continued contraction in industrial production and the dip in retail sales highlight the challenges facing the economy. These indicators suggest a cautious approach from the ECB regarding interest rate adjustments.

As the ECB navigates these uncertain times, its decisions will be crucial in shaping the Eurozone’s economic recovery and stability. The balance between stimulating growth and managing inflation expectations will define the path forward for Europe’s economy.