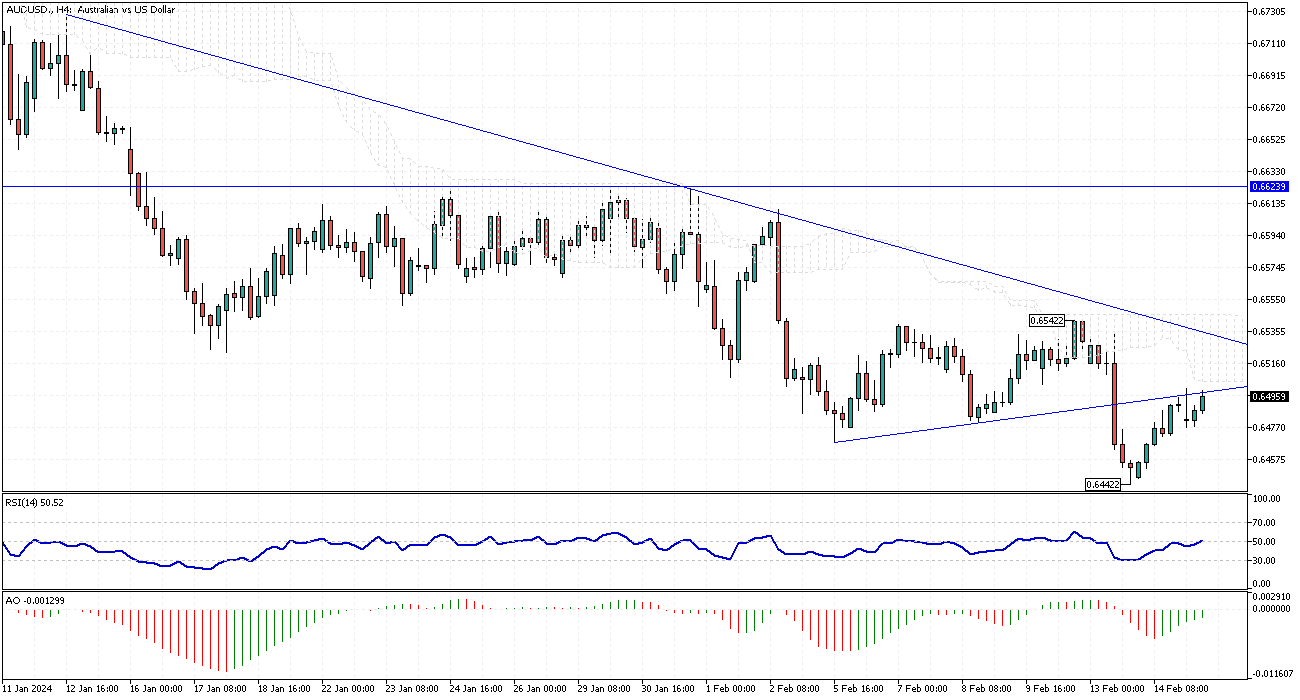

AUDUSD Analysis – February-15-2024

Despite a lackluster response from the markets, the Australian dollar has managed to maintain its ground, floating just below the $0.65 mark. This comes from disappointing job market figures that have led to a more cautious stance on the country’s monetary policy. The unemployment rate in Australia climbed to a two-year peak of 4.1% in January, a stark contrast to the robust growth expected by analysts who had forecasted a surge of 30,000 new jobs, yet only 500 materialized.

These developments have fueled speculation that the Reserve Bank of Australia (RBA) might implement a series of rate cuts totaling approximately 40 basis points over this year, with analysts predicting the initial adjustment to occur in August.

RBA’s Flexible Stance Amid Inflation Concerns

Given the recent economic data, RBA Governor Michele Bullock’s remarks have garnered significant attention. She indicated that the central bank does not necessarily need to wait for inflation to reduce to 2.5% before considering a reduction in the cash rate. This statement underscores a flexible approach toward monetary policy, suggesting that while there is no immediate rush to cut rates, the RBA is not dismissing the possibility of doing so to support the economy.

However, Governor Bullock also noted the potential for further rate hikes if inflation remains stubbornly high, highlighting the central bank’s readiness to adapt its strategy in response to evolving economic conditions.

External Pressures and Future Outlook

Factors beyond domestic economic indicators are also influencing the Australian dollar’s performance. A significant external pressure comes from the strength of the US dollar, buoyed by unexpectedly high US inflation figures, which have quelled expectations of near-term rate cuts by the Federal Reserve.

This international dynamic strains the Aussie as it navigates local economic challenges and global market trends. Moving forward, investors and policymakers will closely monitor the interplay between domestic economic developments and global financial conditions, as these will play a crucial role in shaping the future trajectory of Australia’s monetary policy and the valuation of its currency.