USDCHF Analysis – December-13-2023

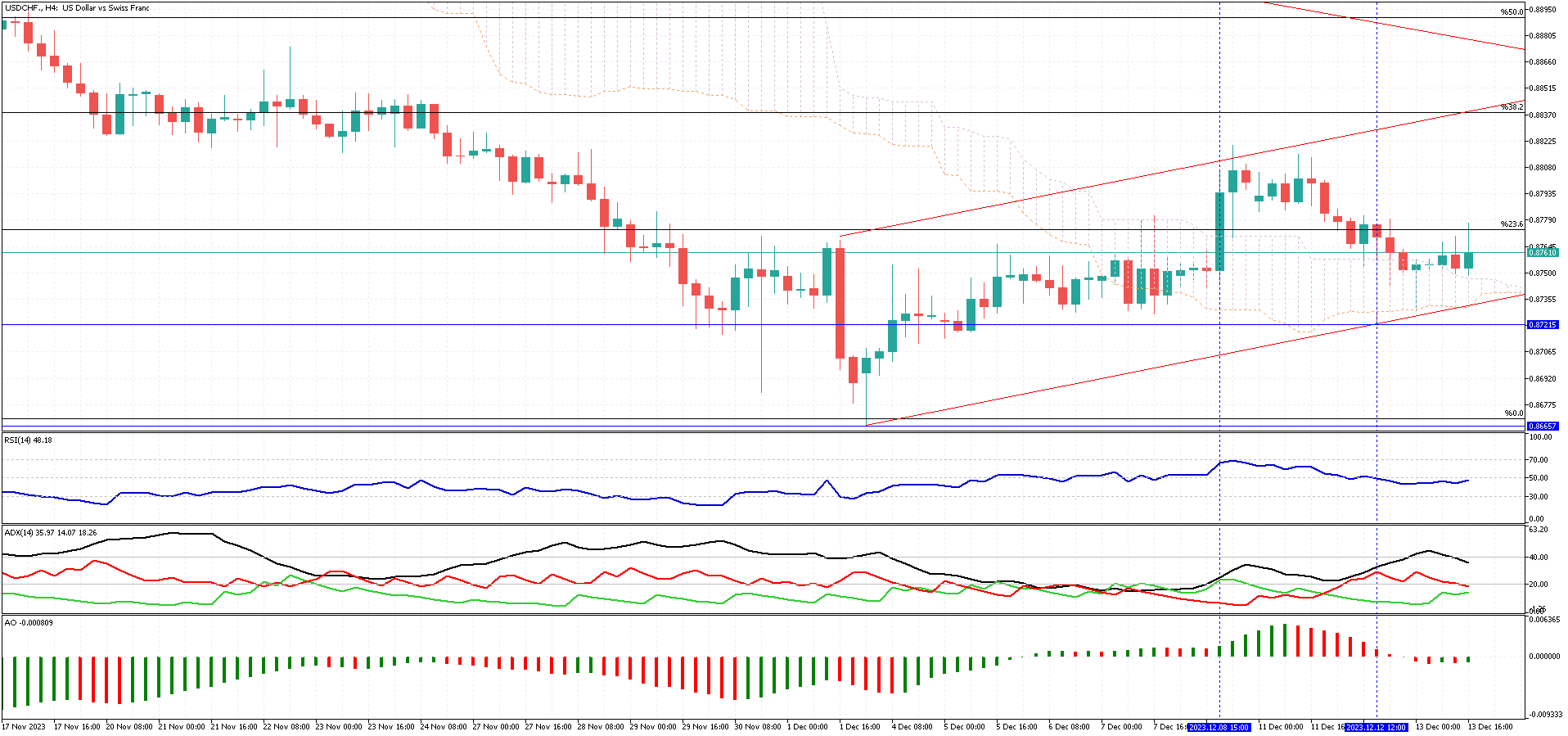

The USDCHF currency pair recently achieved a significant milestone by climbing above the Ichimoku cloud on December 8, indicating a powerful bullish signal. This upward movement was characterized by a large, strong-bodied, bullish candlestick, signifying the buyers’ determination to shift the market trend from bearish to bullish. However, this initial burst of bullish energy has somewhat diminished post-breakout, and currently, the pair is lingering close to the cloud, indicating a possible pause in the upward momentum.

Despite this slowdown, the outlook for the USDCHF isn’t entirely bearish. There remains a potential for the pair to ascend further, particularly if it maintains its position above the cloud. An essential factor in this bullish scenario would be the pair not falling below the November 12 low, as this would sustain the positive sentiment among buyers. Additionally, reaching the 38.2% Fibonacci resistance level could be a key target for the bulls, signaling a continued recovery in the pair’s value.

On the flip side, the dynamics of the USDCHF pair offer a contrasting picture. Here, the sellers, or the bears, appear to be gaining an upper hand. It would signify a solid bearish turn if they drive the price below the Ichimoku cloud. Such a move would likely reinforce the downtrend, with the immediate bearish target being the 0.86657 mark. This level would be crucial as it could act as a significant support, potentially halting the downward momentum or, if breached, exacerbating the bearish trend.