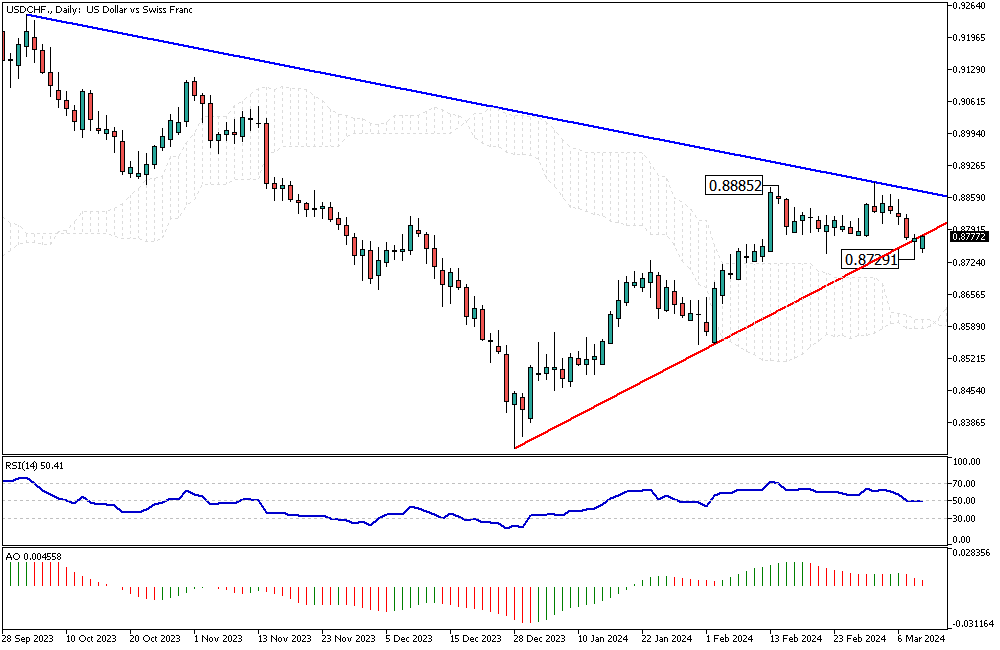

USDCHF Analysis – March-11-2024

USDCHF Analysis – The Swiss franc remains stable at 0.88 against the US dollar, recovering from its recent low. This is because new data shows solid economic performance in Switzerland. In the last quarter of the year, the economy grew more than expected.

It increased by 0.3%, higher than many thought would happen. This growth aligns with what the Swiss National Bank predicted. Because of this positive trend, there’s less talk about reducing interest rates soon.

Inflation Trends and Monetary Policy in Switzerland

Although the economy is doing well, inflation in Switzerland is not going up fast. In January, inflation was only 1.3%, less than people thought it would be. It’s the lowest it has been in more than two years. This low inflation rate is below the Swiss National Bank’s goal for the seventh month.

Even though costs were expected to rise because of changes in taxes and less help with electric bills, inflation has not increased much. This situation has made many people think the Swiss National Bank might lower interest rates in March.

USDCHF Analysis: Market Responses

Despite strong economic growth, over half of the market experts think the Swiss National Bank will cut interest rates soon. This belief comes as inflation remains low, surprising many who expected higher rates due to policy changes.

The Swiss economy’s current condition suggests a cautious approach towards monetary policy. With inflation under control and growth steady, Switzerland looks set for a stable economic future, though eyes remain on the central bank’s next moves.