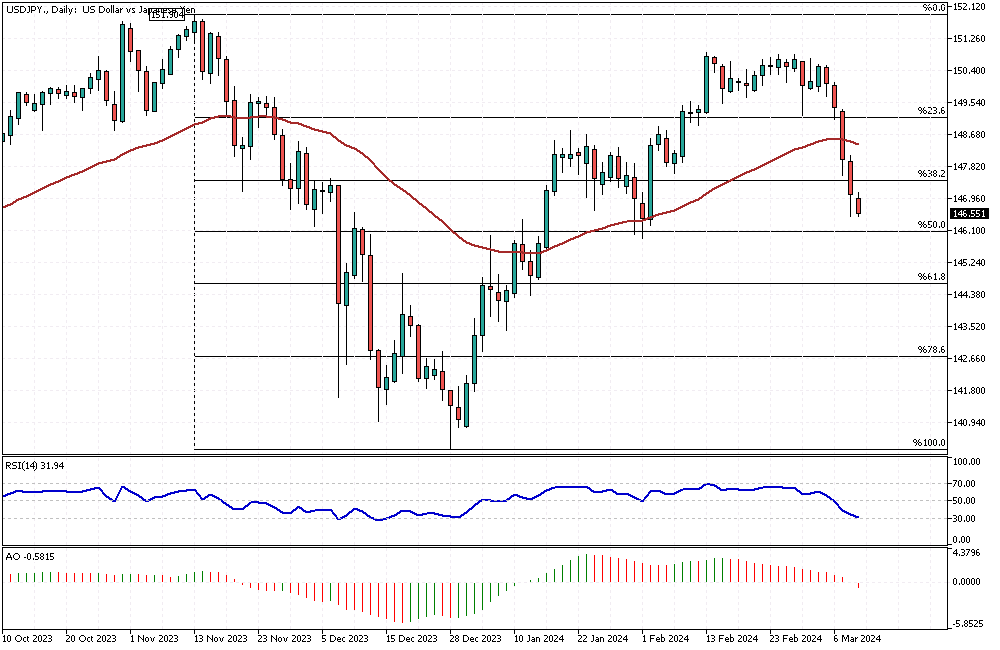

USDJPY Analysis – March-11-2024

USDJPY Analysis – The value of the Japanese yen has soared to its highest in over a month, now more vital than 147 to the dollar. This surge came after new data revealed that Japan’s economy began growing again in the last three months of 2023. To avoid a recession, Japan’s gross domestic product (GDP) increased by 0.4% over the year and showed a slight 0.1% rise from the previous quarter.

This was a positive turn from initial reports, which suggested a decrease in the same periods. The economy had faced a downturn, with a 3.3% yearly drop and a 0.8% quarterly fall in the third quarter.

USDJPY Analysis: BoJ Eyes Interest Rate Hikes

With the economy on the mend, there’s chatter about the Bank of Japan possibly increasing interest rates, which could happen as early as March. This speculation has grown thanks to Japan’s recent economic performance. Junko Nakagawa, a member of the Bank of Japan’s board, has hinted at a brighter future, suggesting that the economy is on the brink of entering a beneficial cycle where inflation and wages rise together. This anticipation adds to the optimism surrounding Japan’s economic outlook.

Yen’s Rise Supported by Global Factors

Besides domestic achievements, the yen is gaining ground due to international events. A weakening U.S. dollar and a drop in Treasury yields have made the yen more attractive. These changes are partly because people think the U.S. Federal Reserve will adopt a more cautious approach to its monetary policy. This global scenario and Japan’s internal economic improvements have played a significant role in the recent appreciation of the yen.