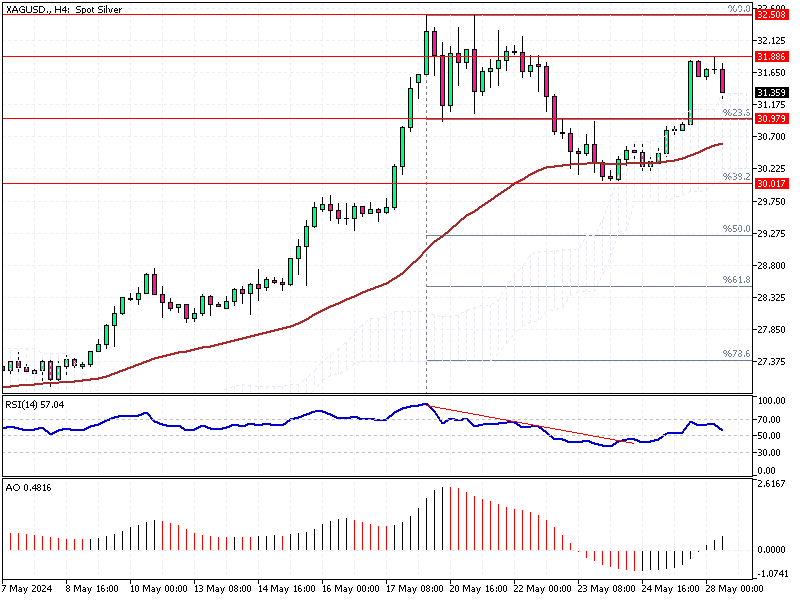

Silver Analysis – May-28-2024

Silver Analysis—Silver prices have recently dropped below $30.5 per ounce, marking a weekly decline of over 3%. This decrease aligns with trends seen across other precious metals. The drop was triggered by the minutes from the latest Federal Reserve meeting.

Silver Analysis – May-28-2024

The minutes revealed that some Fed officials are contemplating raising interest rates. Although the current policy aims to keep the benchmark rate steady, discussions about potential future hikes were also highlighted. This has created a wave of uncertainty among traders.

Now, traders are increasingly uncertain about the Federal Reserve implementing multiple rate cuts in 2024. Despite this uncertainty, there is a 73% probability of at least one rate cut by November. This sentiment shift has significantly influenced market dynamics. (Source Bloomberg)

What This Means for Forex Traders

For forex traders and investors, it’s crucial to stay informed about these developments. Understanding how Fed decisions and market sentiment impact silver prices can help make more informed trading decisions. To stay ahead, keep an eye on future updates and market reactions.

Forex traders can navigate these changes more effectively by staying updated on economic data and market movements and making well-informed decisions in a fluctuating market.