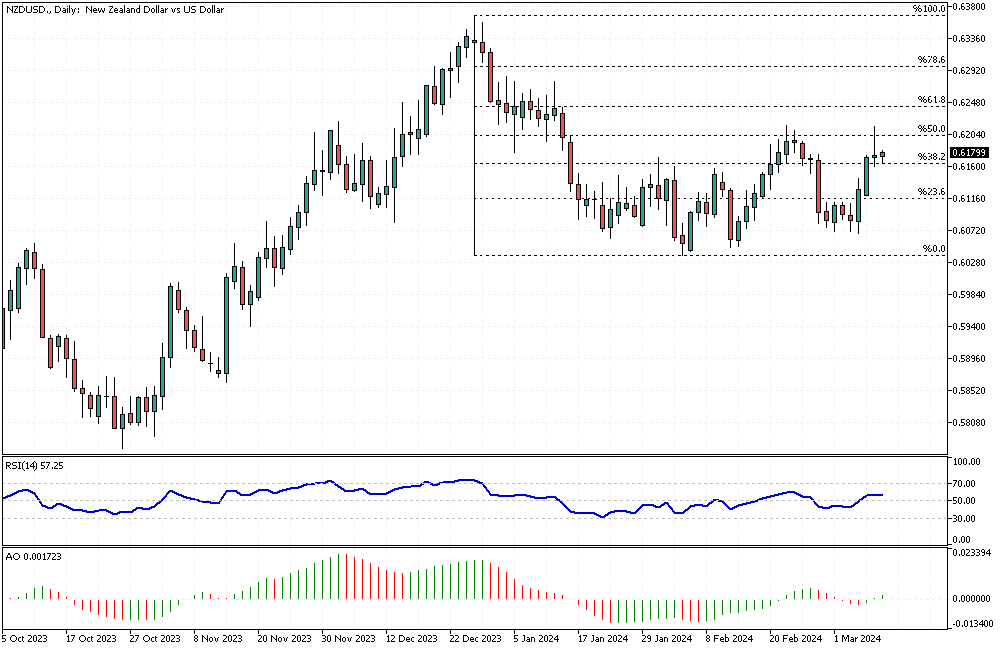

NZDUSD Analysis – March-11-2023

NZDUSD Analysis – The New Zealand dollar has reached its highest value in two weeks, now at about $0.618. This increase is because people think the US Federal Reserve might reduce interest rates before other big banks. Jerome Powell, the leader of the Fed, hinted in his talk with the US Senate that they might start easing up on strict policies if inflation slows down in a way they can trust.

NZDUSD Analysis: Economic Predictions Impacting the Kiwi

In New Zealand, a top economist named Paul Conway noted that the local currency, the Kiwii, might become more robust if the US starts reducing its rates while New Zealand’s rates stay high. He mentioned that this could lead to less inflation pressure, possibly making the Reserve Bank of New Zealand (RBNZ) relax its financial rules earlier than thought. This shift could be significant for local spending and saving.

Reserve Bank of New Zealand’s Monetary Stance

The RBNZ has kept its primary interest rate, the cash rate, at 5.5% for five consecutive times, as seen in their latest meeting in February. They also think the highest rate will be slightly lower than expected, adjusting to 5.6% from 5.7%. This change suggests the RBNZ is starting to see a pathway to possibly less stringent monetary conditions in the future, reflecting a careful approach to handling economic growth and inflation.