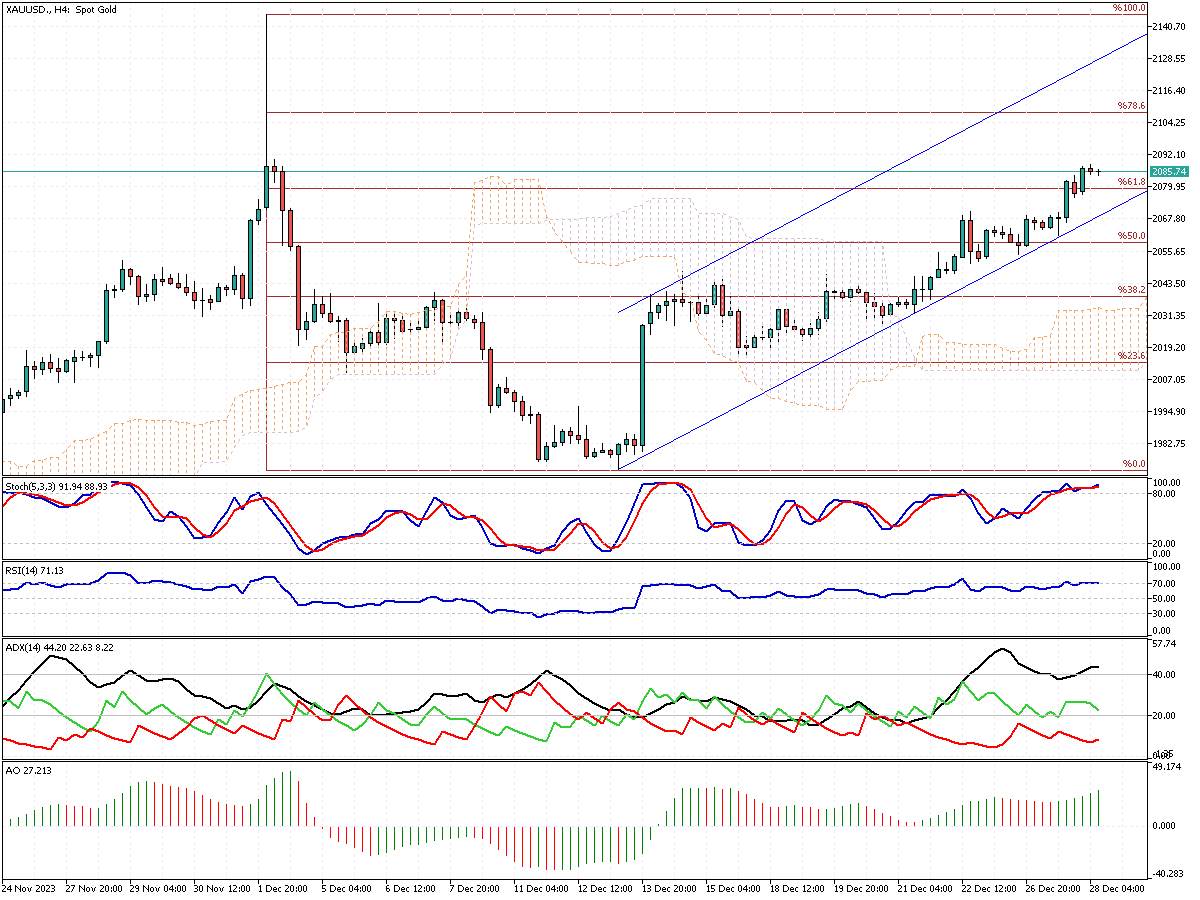

Gold Analysis – December-28-2023

FxNews – In a recent XAUUSD analysis, gold prices surged past $2,080 per ounce on Thursday. This marked its highest level over three weeks, driven by a substantial weakening of the US dollar and Treasury yields. Market participants increasingly anticipate that the US Federal Reserve will initiate interest rate cuts next year.

This sentiment is fueled by signs of easing inflation and the central bank’s strategy to ensure a gradual economic downturn in the US. Current market predictions indicate a near 90% probability of a Fed rate cut in March, with expectations of up to 158 basis points in total reductions next year.

This year, gold’s trajectory in XAUUSD analysis looks promising, with an anticipated increase of over 14%, potentially its first significant annual gain since 2020. Besides the expectations of rate cuts, global factors influence gold’s rise. Conflicts in Ukraine and Gaza and broader geopolitical tensions in the Middle East have intensified the demand for gold as a secure investment.