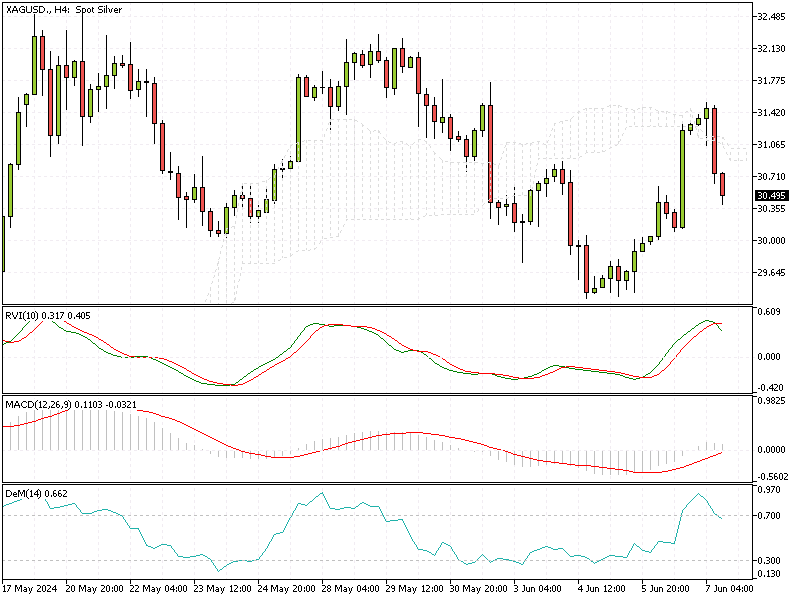

Silver Analysis – 7-June-2024

Silver prices have dropped below $30 per ounce, a significant decrease from the 11-year high of $32 per ounce seen on May 28th. This decline comes as investors evaluate the rate outlook for major central banks and the industrial demand for silver, especially in the solar industry.

Silver Analysis – 7-June-2024

China’s Solar Boom Defies US Tariffs

One of the major factors influencing this trend is the United States’ imposition of a 50% tariff on Chinese solar cell imports. This move is aimed at curbing demand for solar panels manufactured by Chinese companies, which dominate production in Southeast Asia.

Despite this, China’s strong domestic demand has cushioned the fall in silver prices. A prime example is the recent commissioning of the world’s largest solar farm in Xinjiang, highlighting China’s ongoing robust demand for solar energy.

Global Rate Cuts Support Silver Market

Moreover, the expectation that major central banks will cut key interest rates also contributes to limiting the decline in silver prices. Lower interest rates reduce the opportunity cost of holding non-yielding assets like silver.

The European Central Bank (ECB) and the Bank of Canada (BoC) are anticipated to cut rates in their upcoming meetings, and similar actions are expected from the Federal Reserve (Fed), the Bank of England (BoE), and the People’s Bank of China (PBoC) in the third quarter.