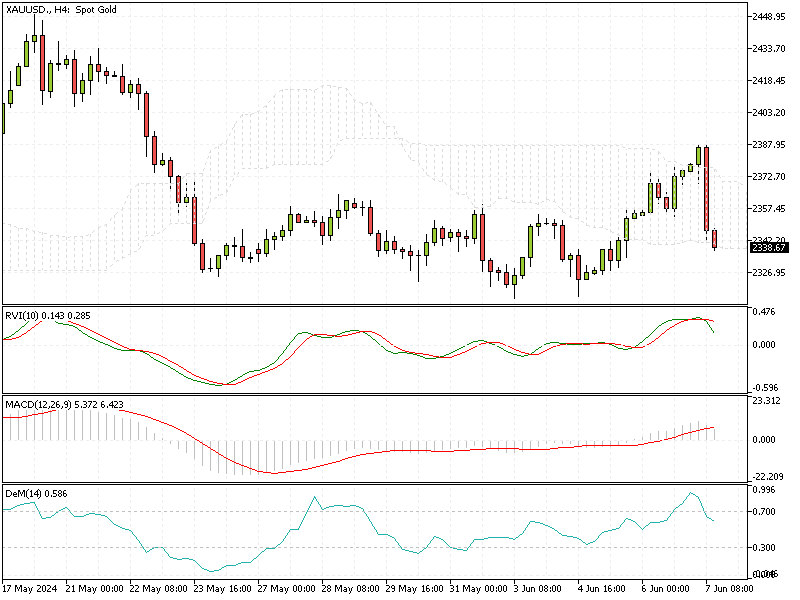

Gold Analysis – 7-June-2024

Gold prices held steady at $2,370 per ounce on Friday, maintaining a near two-week high. This stability comes as investors await the latest US non-farm payrolls data, which is crucial for understanding the health of the US economy and predicting the Federal Reserve’s next moves regarding interest rates.

The data will help investors gauge whether the Fed might cut rates, a decision that significantly impacts gold prices.

Gold Analysis – 7-June-2024

Fed Rate Cut Hopes Elevate Gold

Gold is poised for its first weekly gain in three weeks this week, thanks to recent labor market data. These reports have strengthened expectations that the Fed could cut rates at least twice this year, boosting gold’s appeal as a hedge against lower interest rates and potential economic instability.

ECB Cuts Rates Signals Future Hesitation

On the European front, the European Central Bank (ECB) cut interest rates on Thursday, as anticipated. However, the ECB signaled reluctance to make further cuts soon, even as it adjusted its inflation forecasts upward. This move underscores the complex balancing act central banks face amid fluctuating economic conditions.

Poland Boosts Gold Reserves by 5 Tons

Meanwhile, the Perth Mint reported declining May gold sales, the lowest since March, reflecting varying demand dynamics. In contrast, Poland has increased its gold reserves by 5 tons, with plans for further accumulation. This action highlights a strategic move by some nations to strengthen their financial security with gold.