NZDUSD Analysis – December-15-2023

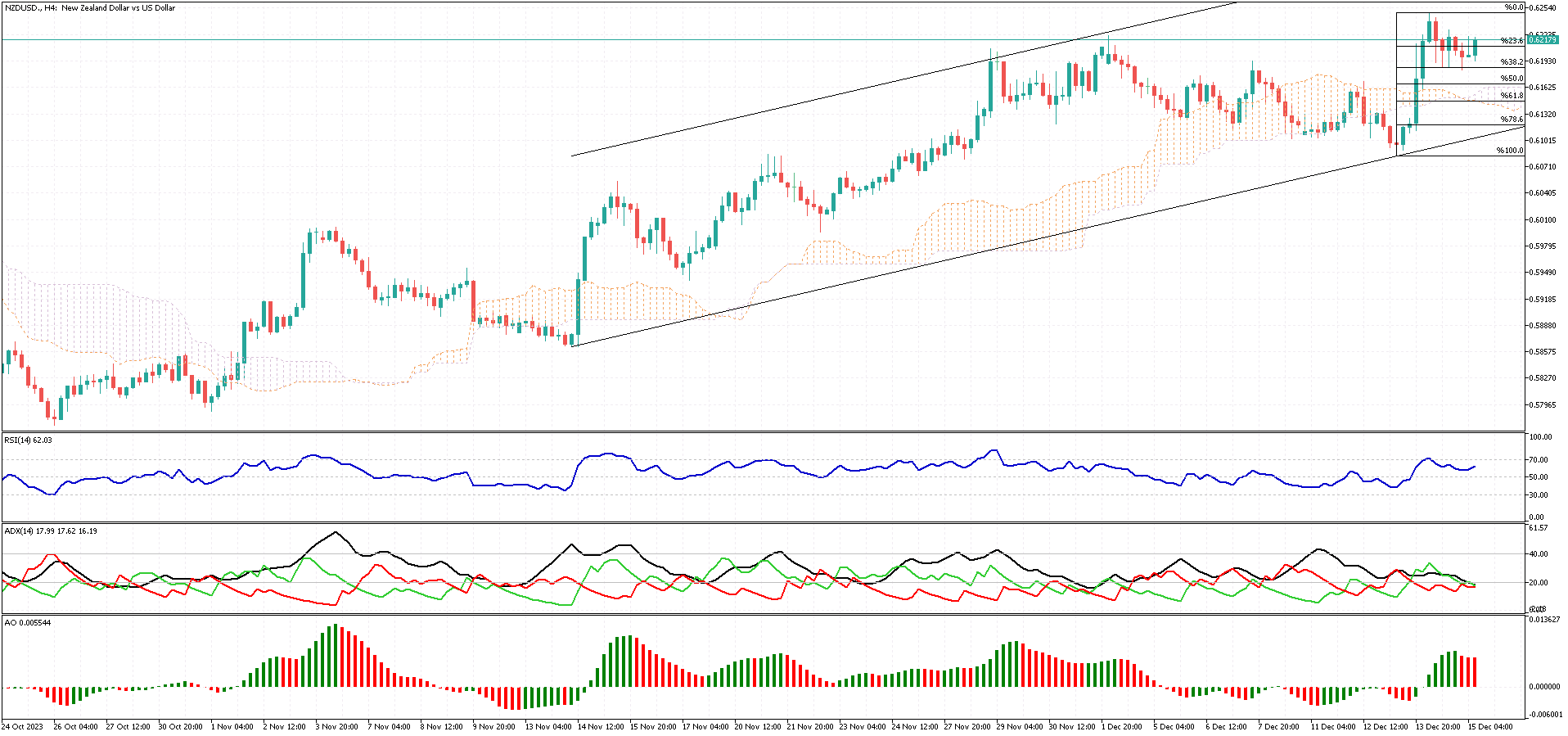

The NZDUSD currency pair recently approached the 38.2% Fibonacci support level. Previously, we predicted this pair would rebound and recover some of its recent gains. If the bulls successfully keep the price above the 38.2% support, we anticipate a rise in the NZDUSD value.

Conversely, should the bears push the price below the 38.2% Fibonacci level, we might see an extended consolidation phase reaching the Ichimoku cloud.

NZX 50’s Steady Growth

Bloomberg – Last Friday, New Zealand’s stock market concluded the day with minimal change, closing at 11,550.21. The day began with a slight dip in the morning but balanced out later. This stability in the market was due to solid performances in consumer goods, technology services, and financial sectors. However, underperformance existed in health technology, non-energy minerals, and communications.

Impact of China’s Economic Data

Investors paid close attention to China’s economic updates. The data for November revealed a mixed picture: industrial production saw its highest increase in two years, but this number might be slightly misleading. It looks higher partly because last year’s figures were low due to pandemic-related lockdowns. Retail sales growth in China was better than before, at 10.1%, but still fell short of the 12.5% increase analysts had expected.

Next week is essential for New Zealand’s economic outlook. The country will release trade figures for the previous month and reports on consumer sentiment for the fourth quarter and business confidence for December. These reports could provide crucial insights into New Zealand’s economic health.

The NZX 50’s Strong Performance

Despite the mixed signals, the NZX 50 – New Zealand’s stock market index – remained at its highest level over three months. It ended the week with a 0.47% increase, marking its seventh consecutive week of growth. This positive trend was bolstered by expectations of three interest rate cuts in the United States next year, which could ease global financial conditions.