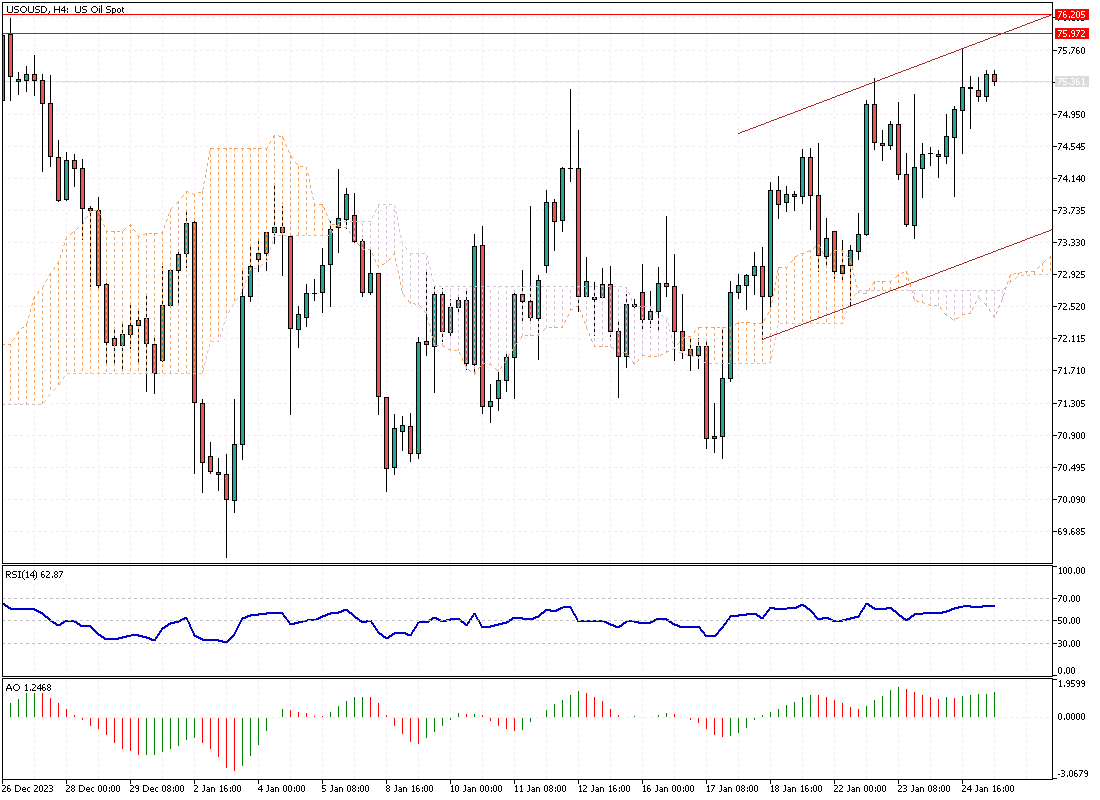

WTI Crude Oil Analysis – January-25-2024

WTI crude futures experienced a notable surge, exceeding $75 per barrel this Thursday. This increase is close to the highest levels observed in the past month. The uplift in oil prices can be attributed mainly to a substantial decrease in U.S. crude inventories. Recent official reports revealed a dramatic decline of 9.233 million barrels in U.S. crude stockpiles last week. This reduction is the most considerable since August and exceeded the anticipated decline of 2.15 million barrels. The unexpected drop in crude inventories has been a primary driver for the recent upward trend in oil prices.

China’s Economic Strategy: A Positive Influence

The bullish sentiment in the oil market is further bolstered by recent economic measures in China, the world’s leading crude importer. The People’s Bank of China made a significant announcement regarding the reserve ratio reduction for banks scheduled for the following month. This strategic move aims to support China’s economy, which has been facing challenges. China’s stimulus is likely to have a positive impact on crude oil demand, contributing to the rising trend in oil prices.

Geopolitical Tensions and Market Impact

Additionally, ongoing geopolitical conflicts continue to influence the oil market. Notably, a coalition led by the United States and the United Kingdom has been actively engaging in strikes against Houthi fighters in Yemen. These Houthi groups have been implicated in numerous attacks on commercial vessels traversing the Red Sea. Such geopolitical tensions and conflicts tend to create uncertainties in the market, often leading to fluctuations in oil prices. The continued vigilance and response to these tensions are critical factors in understanding the global oil market dynamics.