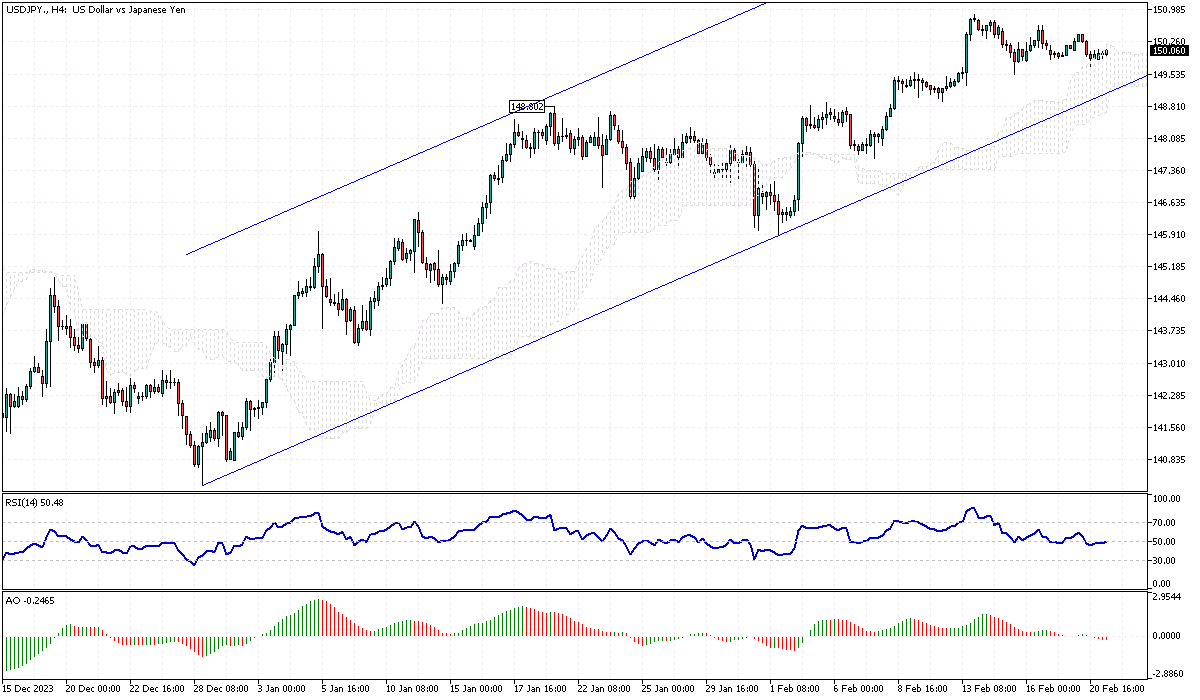

USDJPY Analysis – February-21-2024

USDJPY – The Japanese yen has been teetering around the 150 per dollar mark, a level that historically raises alarm and speculation about potential government intervention in the currency markets. This instability comes as Japan relinquishes its status as the world’s third-largest economy to Germany, coinciding with its slip into a technical recession. The downturn has reinforced the anticipation that the Bank of Japan will persist with its ultra-loose monetary approach.

The situation underscores the yen’s vulnerability and raises questions about the future actions of Japan’s economic policymakers.

NZDUSD Analysis: Policy Responses to Economic Pressures

In response to the yen’s significant depreciation, Japanese Finance Minister Shunichi Suzuki issued a cautionary note last week, highlighting that the authorities vigilantly observe market fluctuations. However, he stopped short of indicating whether a market intervention was imminent. Echoing this sentiment, Masato Kanda, the Vice Finance Minister for International Affairs, stressed that Japan is prepared to take necessary measures to stabilize the forex market, as a rapidly falling yen could further harm the fragile economy.

These statements reflect a strategic ambiguity designed to stabilize market expectations while keeping actual policy moves under wraps.

Global Factors and Monetary Policy Outlook

On the international front, investor sentiment remains entangled with the expectations surrounding the Federal Reserve’s monetary policies, especially in light of conflicting economic indicators from the United States. While strong inflation and employment figures suggest a robust economy, the recent dip in retail sales introduces uncertainty. This juxtaposition impacts global currency valuations, including the yen, as market participants weigh the potential for continued aggressive monetary tightening against signs of economic softening.

Japan’s financial strategies, particularly in the context of its monetary policy, will need to adapt to domestic recessionary pressures and the complex global economic landscape.