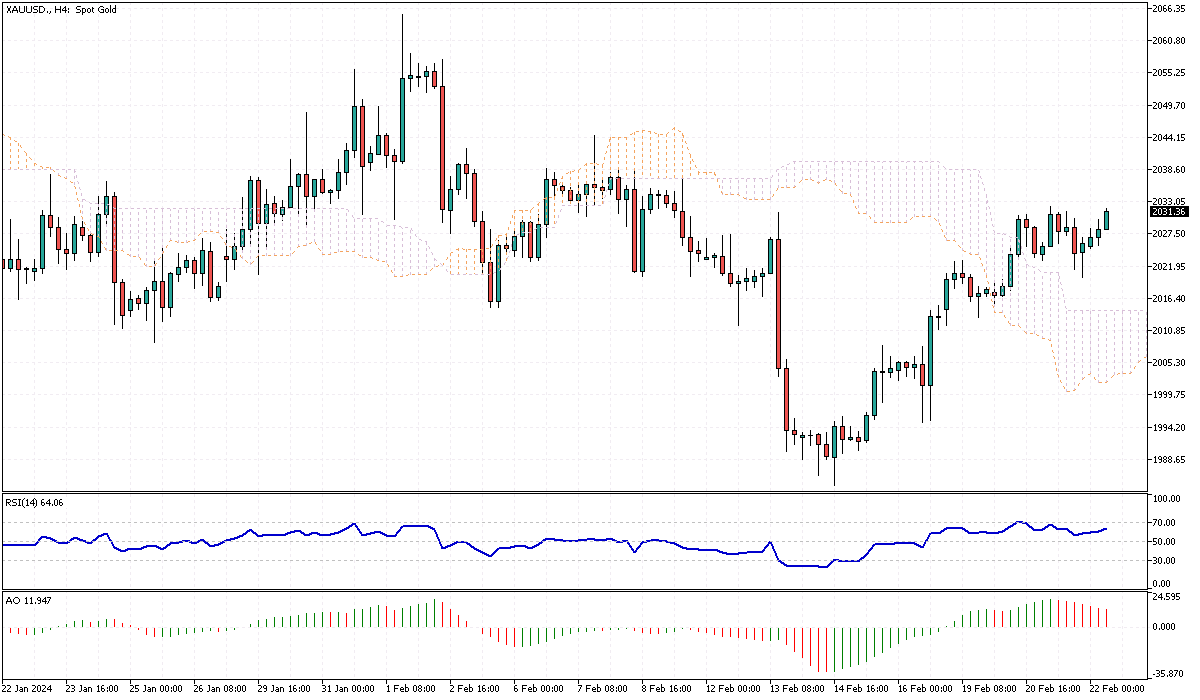

Gold Analysis – February-22-2024

Gold‘s value has increased, reaching approximately $2,030 per ounce this Thursday. This marks a positive trend, with prices rising for the sixth consecutive session. This recent surge is primarily attributed to the depreciating dollar, fueled by the growing uncertainties surrounding the future of U.S. interest rates. The minutes from the latest Federal Reserve policy meeting have revealed a sense of caution among officials regarding premature interest rate reductions, suggesting a possible delay in the commencement of the easing cycle.

This cautious stance has led traders to adjust their expectations, significantly reducing bets for rate cuts in the upcoming March and May sessions. However, anticipation for a reduction remains, with June’s potential 25 basis point cut speculated at a 53% likelihood.

Gold Analysis: Investor Sentiment

The investment community is now focusing on the upcoming flash PMI reports scheduled for release on Thursday. These reports are highly anticipated as they offer a glimpse into the current state of the U.S. private sector, potentially influencing future market trends and investment decisions. The outcome of these reports could provide critical insights, further shaping the landscape of interest rate expectations and currency valuations.

As investors navigate through these uncertain times, the allure of gold continues to strengthen, underscored by its traditional role as a safe-haven asset. This is particularly relevant in the current climate, where geopolitical tensions, especially in the Middle East, are escalating, driving increased demand for more stable investment options.

Gold’s Position in Global Markets

Amidst economic and geopolitical uncertainties, gold has emerged as a beacon for investors seeking stability and safety. The precious metal’s recent price movements underscore its enduring value and appeal in times of turmoil. As global markets grapple with fluctuating interest rates and geopolitical discord, gold’s role as a reliable store of value is increasingly affirmed. Investors worldwide closely monitor developments, using gold as a hedge against inflation and a shield against currency devaluation.

The ongoing situation underscores the importance of diversifying investment portfolios and the strategic role gold plays within them. As the scenario unfolds, understanding market signals and the safe-haven status of gold becomes ever more crucial for informed investment decisions.