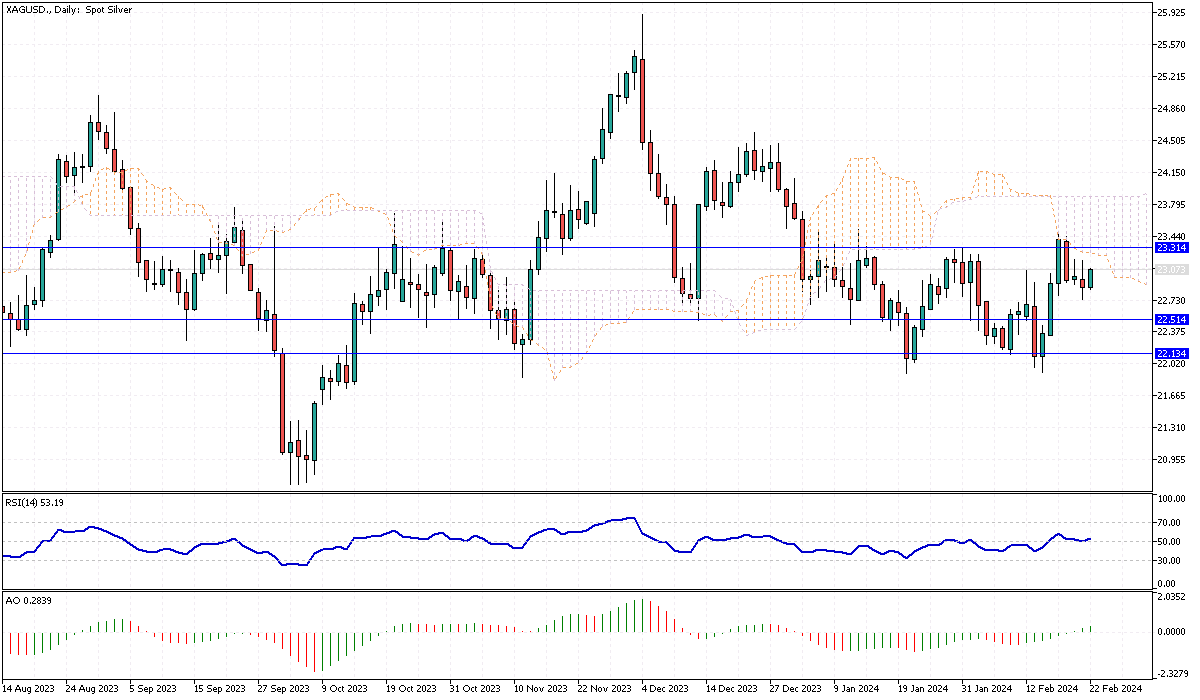

Silver Analysis – February-22-2024

Silver‘s valuation experienced a downward adjustment, moving under $22.9 per ounce following a recent peak. This seven-week high peak was noted at $23.4 per ounce on the 16th of February. This change comes as traders recalibrate their strategies, anticipating potential shifts in the Federal Reserve’s interest rate policies.

Concurrently, geopolitical tensions in the Middle East have nudged some investors towards the precious metal, traditionally seen as a haven during times of uncertainty. However, the Federal Open Market Committee (FOMC) minutes have tempered expectations, indicating the Fed’s cautious stance on rate adjustments.

Rate Expectations and Silver’s Outlook

Investor sentiment initially favored an early rate cut by the Federal Reserve, possibly as soon as March. However, the landscape shifted following the FOMC’s latest communications, pushing the majority consensus towards a 53% probability of a rate decrease of 25 basis points occurring in June. This shift reflects a broader market reassessment and contributes to the volatile pricing of silver.

Yet, despite these immediate market reactions, there remains a positive outlook for silver prices over the year. Analysts anticipate that a weakening dollar and a decline in Treasury yields, spurred by the Fed’s eventual lean towards more supportive monetary policies, will bolster silver’s appeal as an investment.

Long-term Projections and Investment Strategy

Despite the short-term fluctuations, the long-term trajectory for silver prices appears bullish. This optimism is grounded in expectations of a softening dollar and diminishing Treasury yields, traditionally inversely correlated with precious metal prices. As the Federal Reserve aligns with a more dovish monetary stance, silver is expected to regain its luster in the investment community.

This scenario underscores the importance of closely monitoring macroeconomic indicators and central bank signals for investors. Incorporating silver into a diversified investment portfolio could serve as a hedge against inflation and currency devaluation, offering a strategic counterbalance to more volatile assets.