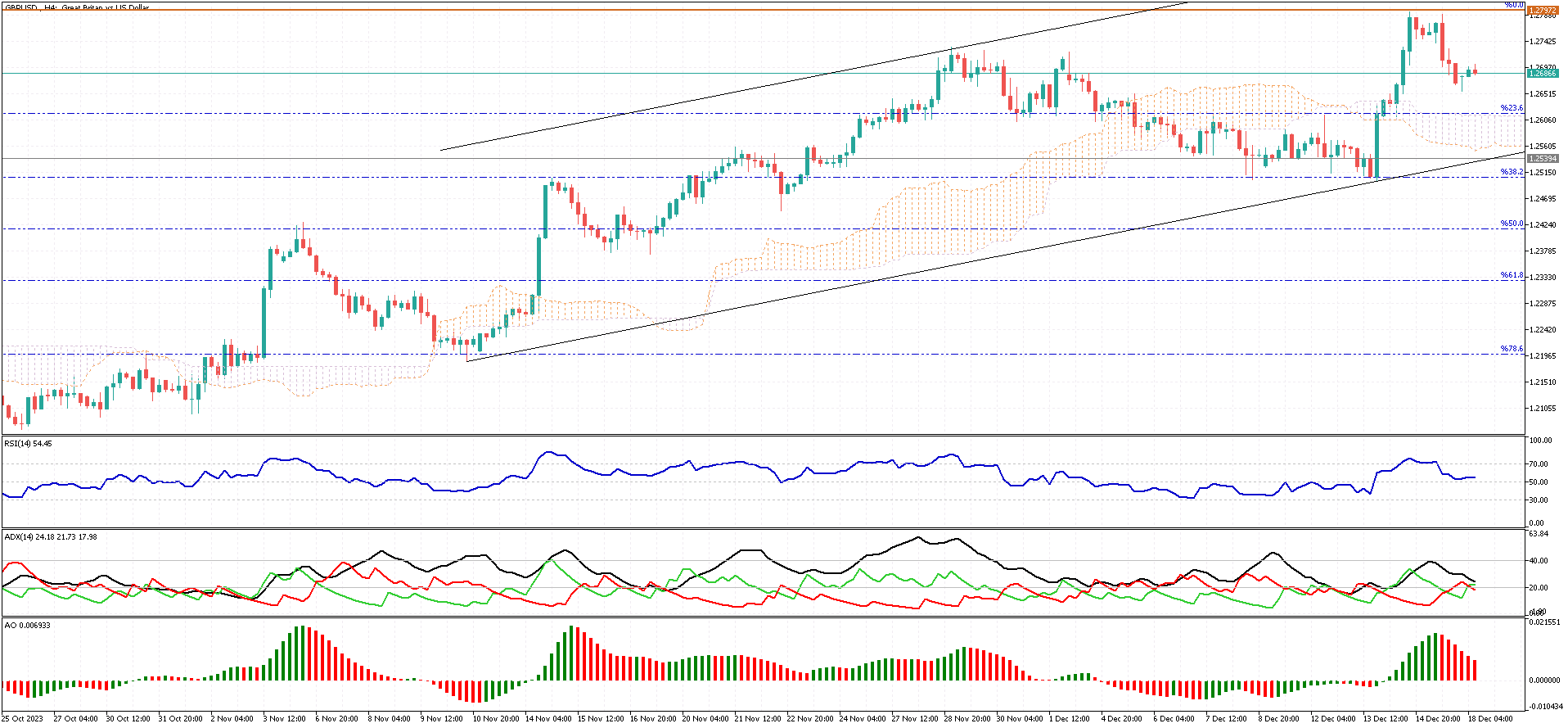

GBPUSD Analysis – December-18-2024

The GBPUSD currency pair experienced a downturn after reaching the 1.2797 resistance level. This resistance has proven significant and formidable, as it has been repeatedly tested throughout the 2023 trading year, indicating its importance in market dynamics. The RSI indicator remains above the 50 lines on the daily Chart, and the Awesome Oscillator’s bars are predominantly green. Collectively, these technical indicators suggest that the bullish market maintains its strength.

It’s insightful to delve into the 4-hour Chart to gain a more nuanced understanding of the current trend. In the 4-hour Chart, the technical indicators present a more mixed picture. Given the prominence of the 1.2797 resistance observed in the daily Chart, there is an anticipation that the GBPUSD price might decline further. As a result, the consolidation phase could extend towards the Ichimoku cloud, potentially reaching the lower band of the bullish flag.

Corporate Dynamics Influence the FTSE 100 Movement

Reuters – On Monday, the FTSE 100 index experienced a slight uplift, rising just above the breakeven point to orbit around the 7,590 level. This performance was notably better than the generally subdued mood across European markets. The focus for investors remains on balancing the Federal Reserve’s potential for more relaxed financial policies against the Bank of England’s stance on maintaining a prolonged period of tight policy. Meanwhile, the market eagerly anticipates the release of crucial inflation data on Wednesday, which is expected to shed light on the trajectory of borrowing costs and their role in managing inflation over time.

From a corporate perspective, Vodafone saw a notable increase of over 4% following news of a proposed merger between Iliad’s Italian operations and Vodafone’s corresponding business units. Energy giants Shell and BP also enjoyed a positive run, benefiting from a slight recovery in crude oil prices.

Conversely, Fresnillo found itself on the downside, witnessing a 5% drop after Morgan Stanley revised its recommendation downward, citing persistent operational cost pressures. Additionally, Centrica’s stock fell by 3% as lower gas prices led analysts at Jeffries to anticipate more normalized profits for the following year.