AUDUSD Analysis – December-18-2023

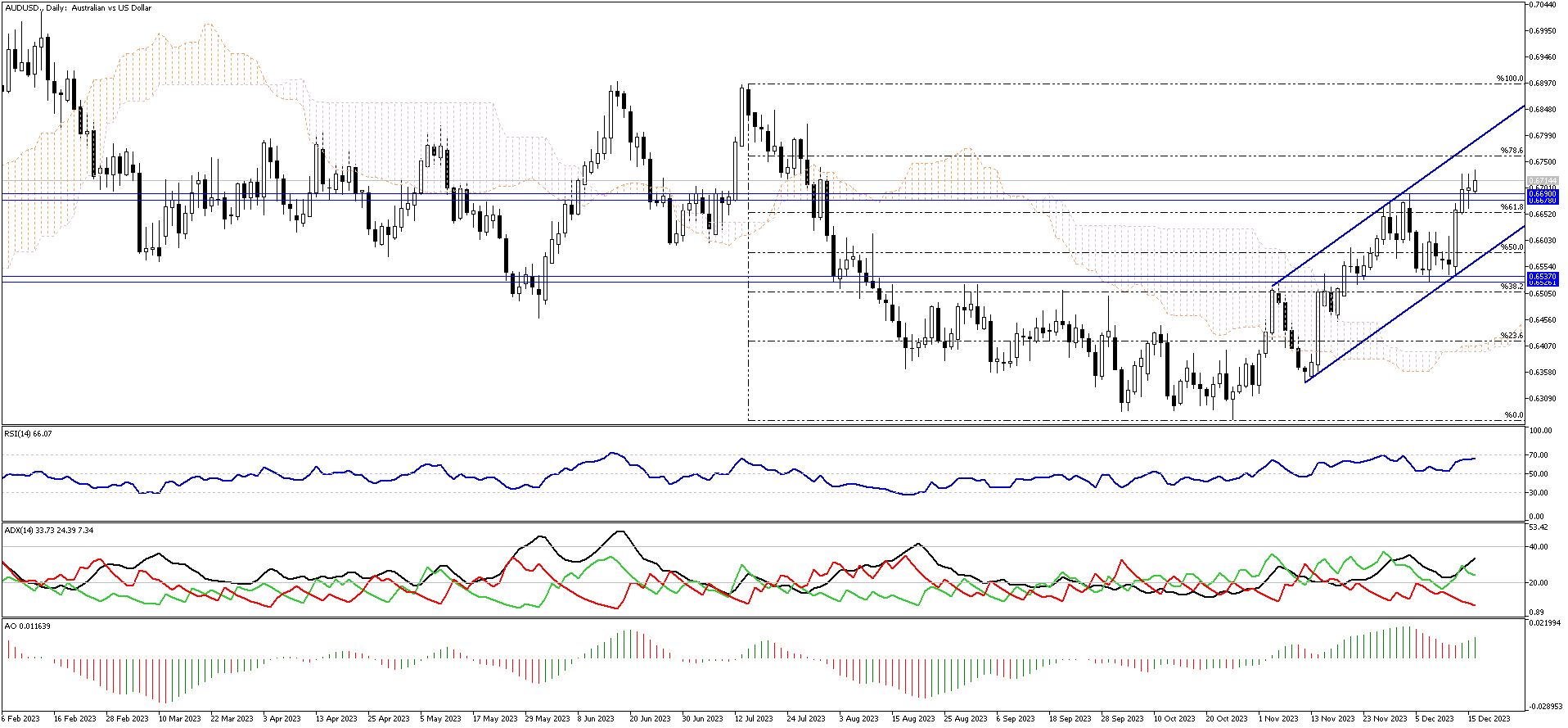

The AUDUSD pair has effectively stabilized above a critical support level in a narrow range between 1.6678 and 1.6690. This stability marks a crucial phase in its technical trajectory.

Regarding the technical indicators, the Relative Strength Index (RSI) is approaching the overbought territory, indicating heightened buying activity. Concurrently, both the Awesome Oscillator and the Average Directional Index (ADX) are signaling a continuation of the bullish trend. While the RSI’s ascent raises the possibility of a consolidation phase, the bullish momentum is still evident, with the next target likely being the upper band of the bullish channel.

Supporting this bullish outlook is the 61.8% Fibonacci retracement level. As long as the AUDUSD pair maintains its position above this level, the bullish trend is expected to persist, with the bulls leading the charge. This aligns with the broader market sentiment, suggesting a potentially sustained upward movement shortly.

S&P/ASX 200 Dips Amid Rate Cut Speculations

Reuters – On Monday, the S&P/ASX 200 Index witnessed a modest decline of 0.22%, settling at 7,426, as it slightly retreated from its highest position in over four months. This downward shift came in the wake of comments from John Williams, President of the New York Federal Reserve Bank, who refuted the possibility of imminent rate cuts during a CNBC interview on Friday. Williams emphasized that the US central bank assesses if the prevailing rates are sufficiently restrictive to reel inflation back to target levels.

In the domestic sphere, investors are now focusing on the upcoming Reserve Bank of Australia policy meeting minutes, which are expected to provide further clarity on the rate outlook. The energy sector led the day’s losses, with notable declines in stocks such as Woodside Energy, down by 0.3%; Santos, falling 1.6%; Ampol Ltd, decreasing by 0.2%; Karoon Energy, dropping 1.5%; and Viva Energy, declining by 1.2%. Other significant players in the index, including Transurban Group, Wesfarmers, and QBE Insurance, experienced downturns, closing lower by 0.9%, 0.5%, and 0.6%, respectively.