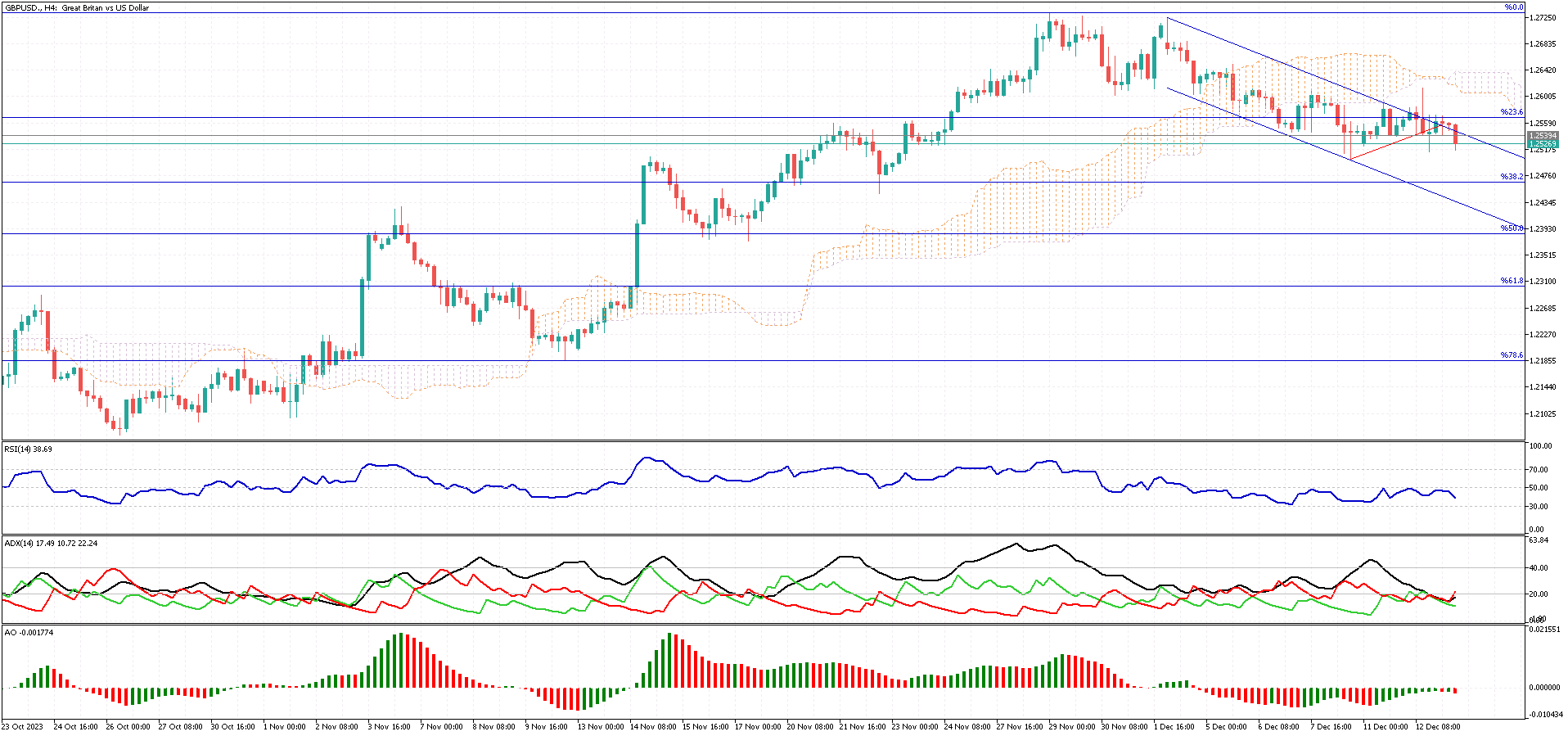

GBPUSD Analysis – December-13-2023

The GBPUSD currency pair recently struggled to breach the Ichimoku cloud. Consequently, it fell back below the 23.6% Fibonacci level. Regarding technical indicators, the Relative Strength Index (RSI) remains below 50, suggesting a lack of momentum. Similarly, the Average Directional Index (ADX) indicates a weak trend but with a bearish inclination as it edges above the 20 level. Furthermore, the Awesome Oscillator’s bars have turned red, reinforcing the bearish outlook.

These technical indicators align in their assessment, pointing towards the likelihood of the downtrend’s continuation. The bearish trend will persist as long as the GBPUSD price stays below the Ichimoku cloud. The first bearish target in this scenario would be the 38.2% Fibonacci support level.

Conversely, the bullish scenario becomes void if the pair crosses above the Ichimoku cloud.

FTSE 100 Sees Slight Rise

Bloomberg – On Wednesday, the FTSE 100 slightly increased, hovering around the 7550 mark. This movement comes as traders absorb new economic data and await critical decisions from the Federal Reserve later today, followed by the Bank of England tomorrow. Surprisingly, the British economy showed a contraction in October, fueling speculation that the Bank of England might lean towards reducing interest rates next year.

Corporate Movements Impacting the Market

In the corporate sector, there were notable shifts. Entain, a leading company, witnessed its shares climb by approximately 3.5%. This increase followed the sudden resignation of its CEO, Jette Nygaard-Andersen. Other companies, including Rolls-Royce, Rentokil, Howden Joinery Group, Flutter Entertainment, and Convatec, also experienced gains, each rising about 1.3%.

Conversely, B&M faced a decline, dropping 5.5% after the announcement of a share placing at a slight discount to its closing price, aiming to raise £162.1 million.