EURUSD Technical Analysis: European Stocks Stable

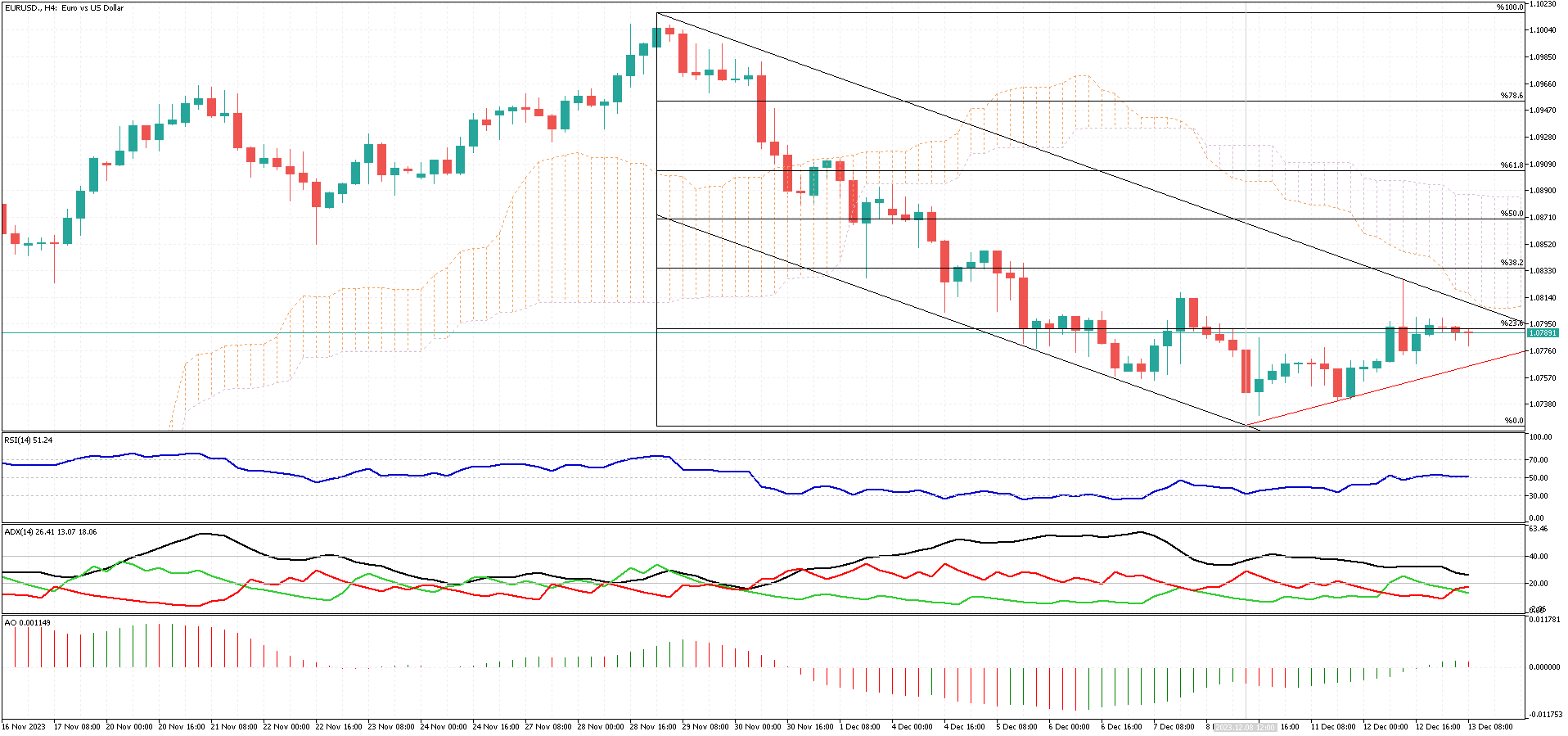

The EURUSD pair has recently come up against a crucial resistance point, marked by the 38.2% Fibonacci level. This barrier is strengthened further by the Ichimoku Cloud, adding to its significance. The current scenario shows that as long as the price of EURUSD doesn’t break above this level, the bearish sentiment in the market remains a key factor. If this downward trend continues, the focus shifts to the next possible milestones for the currency pair. The immediate target for those betting on a decline could be the lowest point the pair hit in December. After that, the aim might shift to the lower end of the ongoing bearish channel.

European Stocks Stable

Bloomberg – On Wednesday, European stock markets displayed a calm demeanor. Key indexes like the STOXX50 and the broader STOXX 600 maintained their highs, dating back 23 years and 22 months respectively. This steady state comes as market players gear up for significant announcements. They are particularly focused on the Federal Reserve’s rate decision, along with critical meetings from the European Central Bank and the Bank of England, all set for Thursday.

Economic Data in Focus

Investors are also pondering over recent economic figures. Notably, the UK economy showed a slight downturn in October, shrinking by 0.3%. This shift is a turnaround from the 0.2% growth seen in September and defies the forecasts which anticipated a stable GDP. Adding to the economic landscape, Germany’s IW economic institute forecasted a 0.5% shrinkage in the nation’s economy for 2024, pointing to looming uncertainties tied to a budget crisis.

Inditex, the fashion giant, celebrated a significant 32.5% jump in net profit from February to October. On a different note, Renault, the automobile manufacturer, announced plans to sell a 5% stake in Nissan back to the Japanese company. This move marks the beginning of Renault’s strategy to reduce its holdings in Nissan.