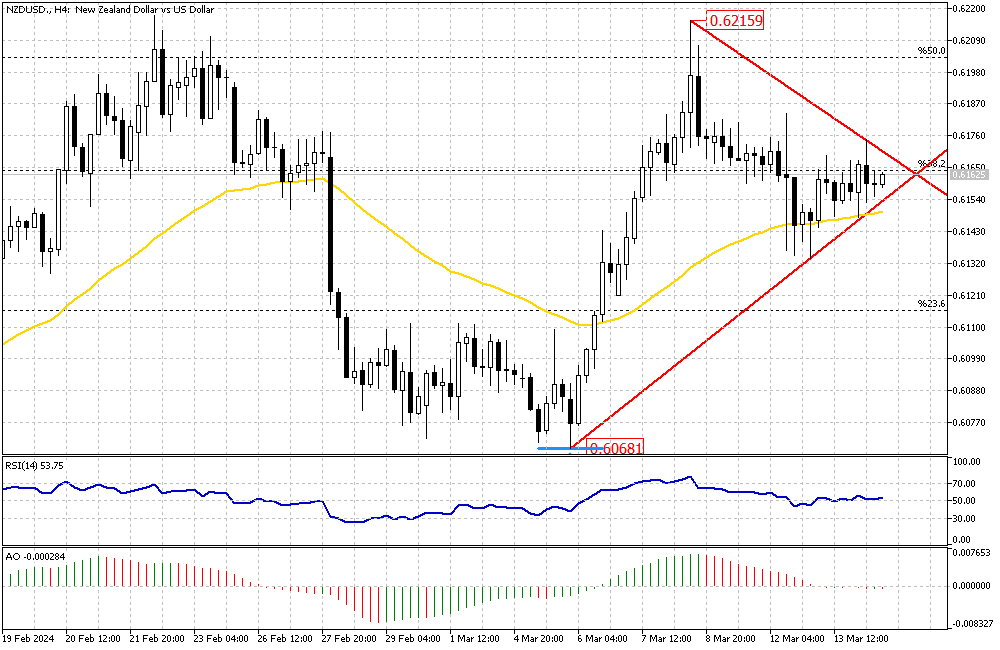

NZDUSD Analysis – March-14-2024

NZDUSD Analysis — The New Zealand dollar recently found stability, hovering around the $0.616 mark. This stability comes after significant fluctuations triggered by unexpectedly strong US inflation figures, which have introduced uncertainties regarding the Federal Reserve’s interest rate reduction timeline.

Despite these global economic tremors, the New Zealand dollar has found some footing, buoyed by the anticipation that the US Federal Reserve might commence its policy relaxation ahead of other leading global financial institutions. This expectation cushions against the volatile international economic winds affecting the currency.

Insights from the Reserve Bank of New Zealand

Paul Conway, the Chief Economist of the Reserve Bank of New Zealand, recently shared insights suggesting potential shifts in the economic landscape. According to Conway, the US Federal Reserve should start reducing interest rates towards the year’s end. At the same time, New Zealand maintains higher domestic rates; the New Zealand dollar could see an increase in value. This change would help mitigate inflationary pressures within the country.

However, Conway also highlighted a significant caveat: this scenario might prompt the Reserve Bank of New Zealand to reconsider and possibly lower its monetary settings sooner than expected in response to evolving economic conditions.

Current Monetary Policy Stance and Future Projections

The Reserve Bank of New Zealand has maintained a steady course in its recent approach to monetary management. During the latest February policy meeting, the cash rate remained constant at 5.5% for the fifth consecutive time. This decision aligns with the broader strategy of ensuring economic stability and managing inflation.

Interestingly, the Reserve Bank has adjusted its forecast, expecting the peak rate to hit 5.6%, a slight decrease from the previous 5.7% projection. This adjustment reflects a nuanced understanding of the economic indicators and a responsive approach to global and domestic financial developments, ensuring that the monetary policy remains aligned with the evolving economic landscape.