GBPUSD Drops as Central Banks Caution on Rates

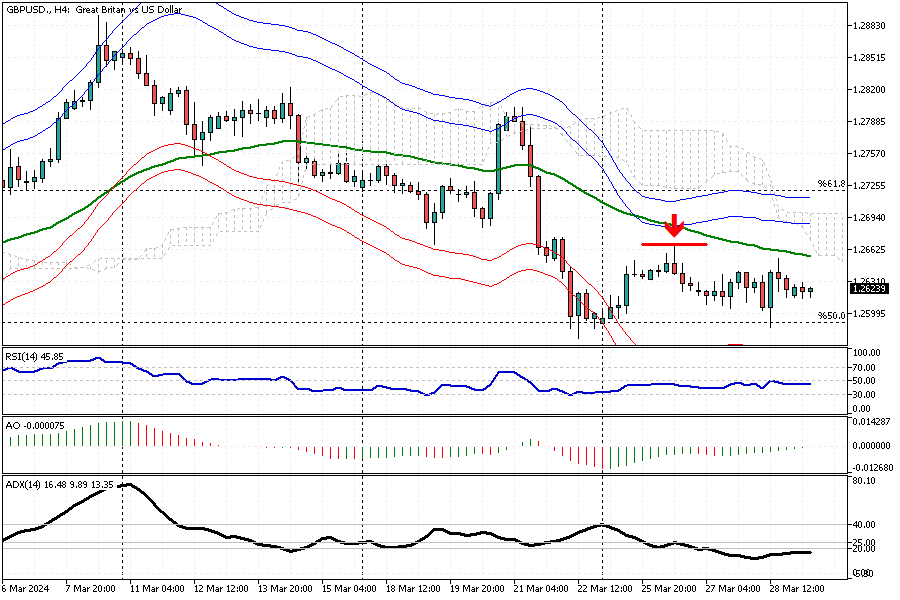

GBPUSD Analysis – Towards the end of March, the British pound fell to around $1.26, its lowest point since February 19th, and it’s on track to lose nearly 1% against the US dollar this quarter. This trend comes as investors take in warnings from central bank leaders.

The Federal Reserve’s Waller stated that recent inflation figures argue against the US lowering its short-term interest rate target anytime soon. However, he didn’t rule out rate cuts later. In contrast, Bank of England’s Haskel thinks rate cuts should be far off, and Mann warns not to expect too many rate cuts in the UK this year, suggesting the UK will likely wait for the Fed’s move.

During its March meeting, the Bank of England decided to keep interest rates the same, with two members who previously wanted higher rates now preferring to wait, pushing the bank’s approach to a gentler stance than expected.