EURUSD Falls in March – Investors Eye Rate Cuts

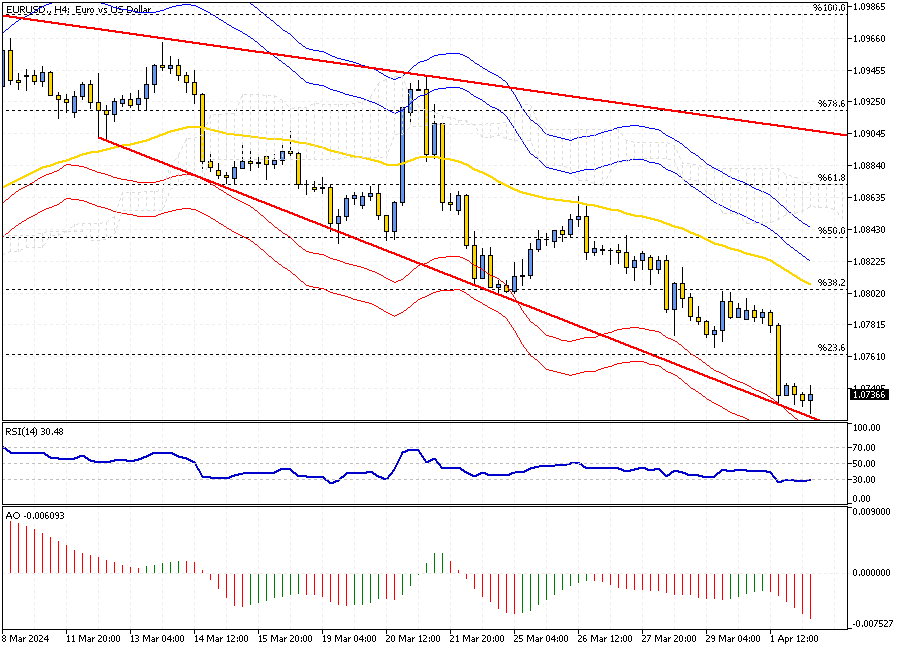

EURUSD Analysis – At the end of March, the euro fell to just under $1.08, marking its lowest point since February 19th. This drop signifies a nearly 2% decrease over the quarter compared to the US dollar. This change happened as investors adjusted their expectations for the Federal Reserve’s significant cuts in interest rates. This shift was due to vital economic signs from the US and cautious words from central bank leaders.

On Wednesday, Federal Reserve Governor Christopher Waller pointed out that there’s no rush to reduce interest rates despite inflation’s high. However, he did not dismiss the possibility of rate changes later in the year.

On the other hand, Europe saw ECB’s Piero Cipollone express more optimism about inflation getting back to the 2% goal by mid-2025, thanks in part to slowing wage increases. This optimism supports the possibility of lower interest rates. The ECB is expected to cut rates in June, but there’s a mix of opinions on whether there will be two or three more cuts by the end of the year.