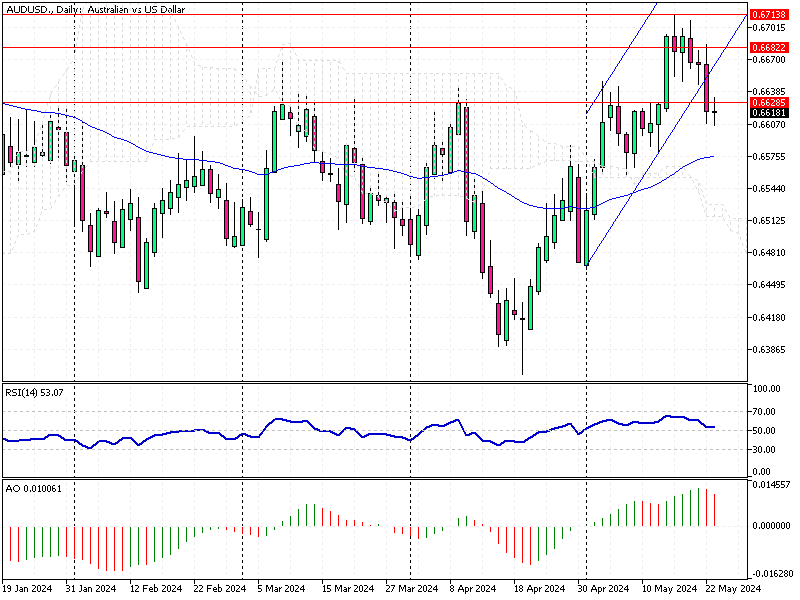

AUDUSD Analysis – Fed Hawkish Stance

The Australian dollar held around $0.662 (AUD/USD) despite experiencing a 1% drop for the week. This decline was influenced by the US dollar’s strength, driven by hawkish signals from the latest Federal Reserve policy meeting minutes.

AUDUSD Analysis – Fed Hawkish Stance

The minutes from the Federal Reserve meeting revealed that participants were concerned about persistent inflation. Some members indicated a willingness to tighten policy further if inflation picked up again. This hawkish tone boosted the US dollar, putting pressure on the Australian dollar.

Reserve Bank of Australia’s Dilemma

Bloomberg—Domestically, the Reserve Bank of Australia (RBA) also discussed interest rates significantly. The latest meeting minutes showed that the board considered raising rates in May but ultimately decided to keep them steady.

The RBA acknowledged the difficulty in ruling out future changes in the cash rate, emphasizing that the flow of economic data had increased the risk of inflation staying above target for a prolonged period.

Australian Inflation Expectations Decline

On a positive note for Australia, consumer inflation expectations fell to 4.1% in May, the lowest since October 2021. This drop suggests Australians feel more optimistic about inflation, which could influence future RBA decisions.

Implications for Forex Traders

These developments underscore the importance of monitoring central bank policies and inflation data for forex traders. The interplay between the Federal Reserve’s hawkish stance and the RBA’s cautious approach creates a dynamic environment for the Australian dollar. Staying informed about these factors will help traders make better decisions in the forex market.