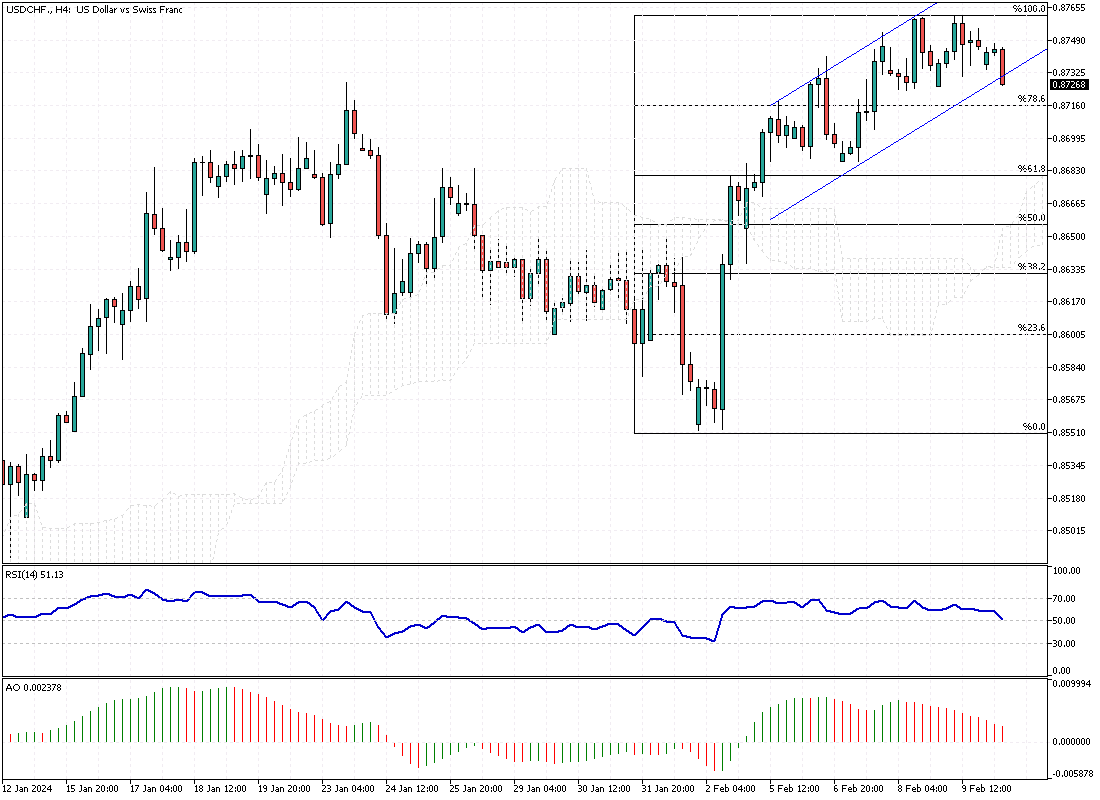

USDCHF Analysis – February-12-2024

USDCHF – In early February, the Swiss franc fell to its lowest level in nearly two months, dropping below 0.87 against the US dollar. This decline was mainly due to the strong performance of the US dollar, fueled by hawkish statements from Federal Reserve Chair Powell and positive economic data from the US.

These developments led to expectations that the Federal Reserve might delay any interest rate cuts until May. Various international and domestic factors influence the Swiss franc’s value, and its recent dip reflects broader economic trends.

Swiss Franc’s Recent Decline

Switzerland’s economic indicators have also influenced the franc’s valuation. The Chairman of the Swiss National Bank (SNB), Jordan, mentioned an upward revision in the bank’s inflation forecast for the year. This adjustment was attributed to increased value-added tax and the gradual removal of electricity subsidies, which could potentially heighten inflationary pressures within Switzerland.

However, the central bank anticipates that inflation will stay under the 2% target for the year, suggesting a possibility for more relaxed monetary policies. Despite these challenges, inflation rates have consistently remained below 2%, indicating a stable economic environment.

The Role of the Swiss National Bank

The Swiss National Bank has been actively managing the franc value through foreign exchange interventions, a strategy reflected in the nation’s foreign reserves hitting seven-year lows. These efforts aim to stabilize the franc and mitigate excessive fluctuations that could impact the Swiss economy.

Such interventions highlight the SNB’s commitment to maintaining economic stability despite global financial dynamics and domestic fiscal policy pressures. As the Swiss economy navigates through these challenges, the central bank’s actions will be crucial in shaping the franc’s trajectory and ensuring its alignment with broader economic goals.