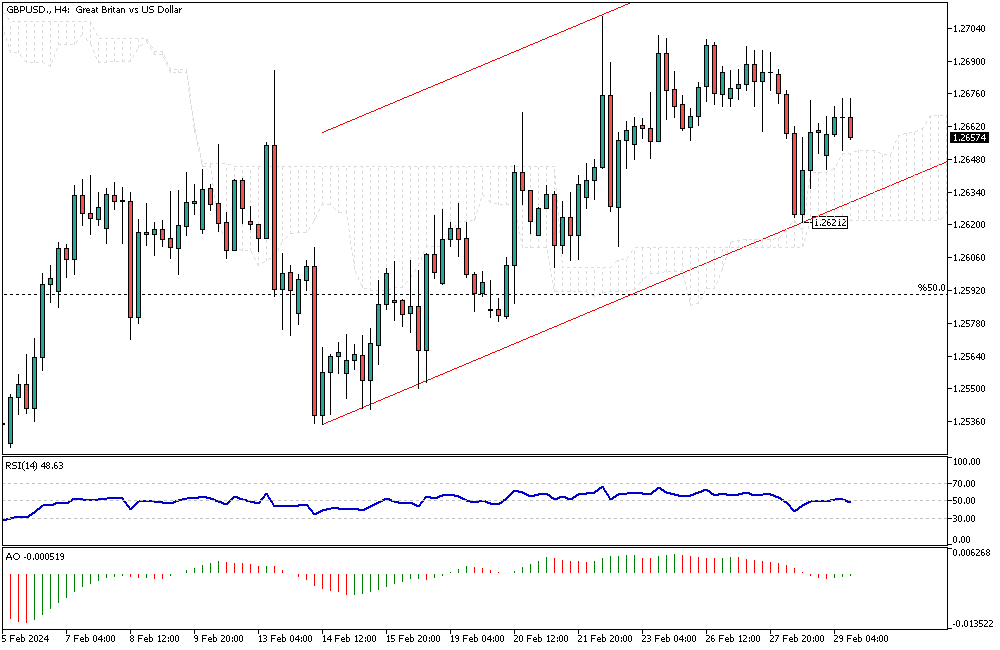

GBPUSD Analysis – February-29-2024

GBPUSD Analysis – The British pound experienced a decline, moving closer to $1.26. This occurred as global investors held their breath for critical inflation data. This week, both the US and the Eurozone are set to release figures. These are anticipated to play a significant role in shaping the monetary strategies of the Federal Reserve and the European Central Bank.

GBPUSD Analysis: Recent Strength and Outlook

Previously, the pound showcased its most substantial weekly rise in 2024 compared to the dollar. This uplift was due to a positive survey on business activity. The survey hinted at the UK’s potential quick recovery from its recent economic downturn. Thus, the mood among traders and analysts improved markedly.

Anticipations and Monetary Policy

Now, the focus shifts to the actions of central banks. Market participants are leaning towards an expectation. They foresee the Bank of England implementing a rate reduction as soon as August. At the same time, there’s a prediction about the Federal Reserve and the European Central Bank. Both might enact similar cuts by June, as per current market speculations. This anticipation shapes investment strategies and economic forecasts globally.