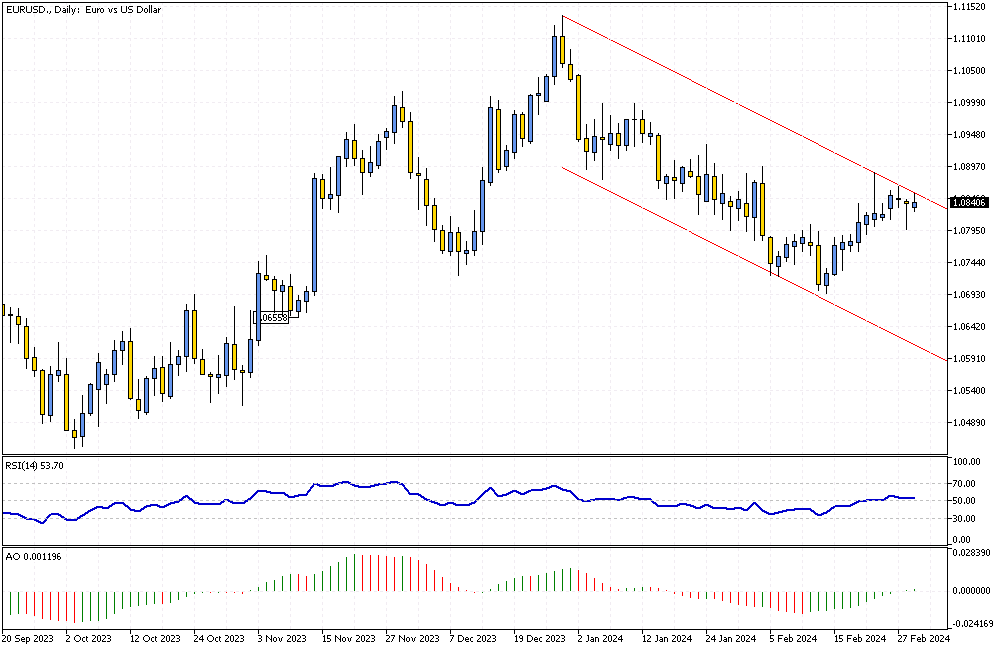

EURUSD Analysis – February-29-2024

EURUSD Analysis – The euro remained stable, exceeding the $1.08 threshold. This occurred as market participants analyzed fresh inflation statistics from the leading economies within the Eurozone. They also assessed how these figures might influence the direction of the European Central Bank’s monetary policies.

Notably, France’s inflation decelerated to 2.9% in February, marking its lowest since January 2022. Additionally, Spain reduced its inflation rate to 2.8%, a figure not seen in the past six months. These changes were slightly higher than the anticipated 2.7%.

EURUSD Analysis: Economic Shifts in the Eurozone

Furthermore, there’s a noticeable deceleration in inflation within Germany, the powerhouse of Europe. This trend adds another layer to the overall economic landscape of the region. Parallel to these inflation developments, there’s been a subtle shift in the Eurozone’s lending activities. Specifically, there was a slight decrease to 0.3% in January from the previous 0.4% in December. This indicates a cautious approach to monetary circulation within the economy, reflecting broader economic sentiments.

Market Expectations and ECB’s Future Moves

Consequently, traders have adjusted their expectations for the European Central Bank’s interest rate decisions. Initially, the market foresaw around 150 basis points in rate reductions for the year. Now, expectations have moderated to approximately 90 basis points. This adjustment stems from the Eurozone’s evolving economic indicators and inflation trends. It highlights the market’s ongoing adaptation to new data and the anticipation of the ECB’s response to these economic shifts.