Fed Rate Cuts to Propel Oil Demand?

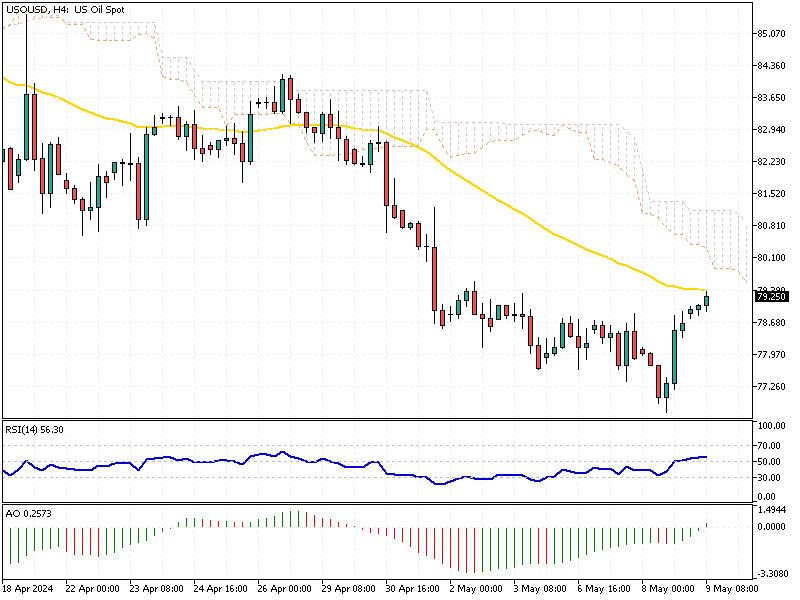

WTI crude futures significantly increased, climbing above $79 per barrel this Thursday. The latest official data revealed that a notable drop influenced this rise in U.S. oil stockpiles.

The Energy Information Administration (EIA) reported a decrease of 1.361 million barrels in crude inventories last week, a reversal from the 7.265 million barrel increase observed previously. This decline is attributed to heightened refinery activity, suggesting a potential tightening in oil supply.

Fed’s Rate Cut Prospects Boost Oil Demand

The energy market’s outlook received an additional boost from the growing anticipation that the U.S. Federal Reserve might reduce interest rates later this year. Forex traders and investors keenly watch such economic policy adjustments as they often lead to increased energy consumption and higher oil prices.

However, despite these positive signals, oil prices still hover near two-month lows.

Fed Rate Cuts to Propel Oil Demand?

Compounding the market’s complexity, geopolitical tensions have shown signs of easing in the Middle East. Following advancements toward avoiding broader conflicts between Israel and Iran and increasing hopes for a ceasefire in Gaza, oil prices have been under additional pressure.

Moreover, the uncertainty surrounding the future production policies of OPEC+ ahead of their meeting on June 1 adds another layer of unpredictability for traders and investors in the forex markets.