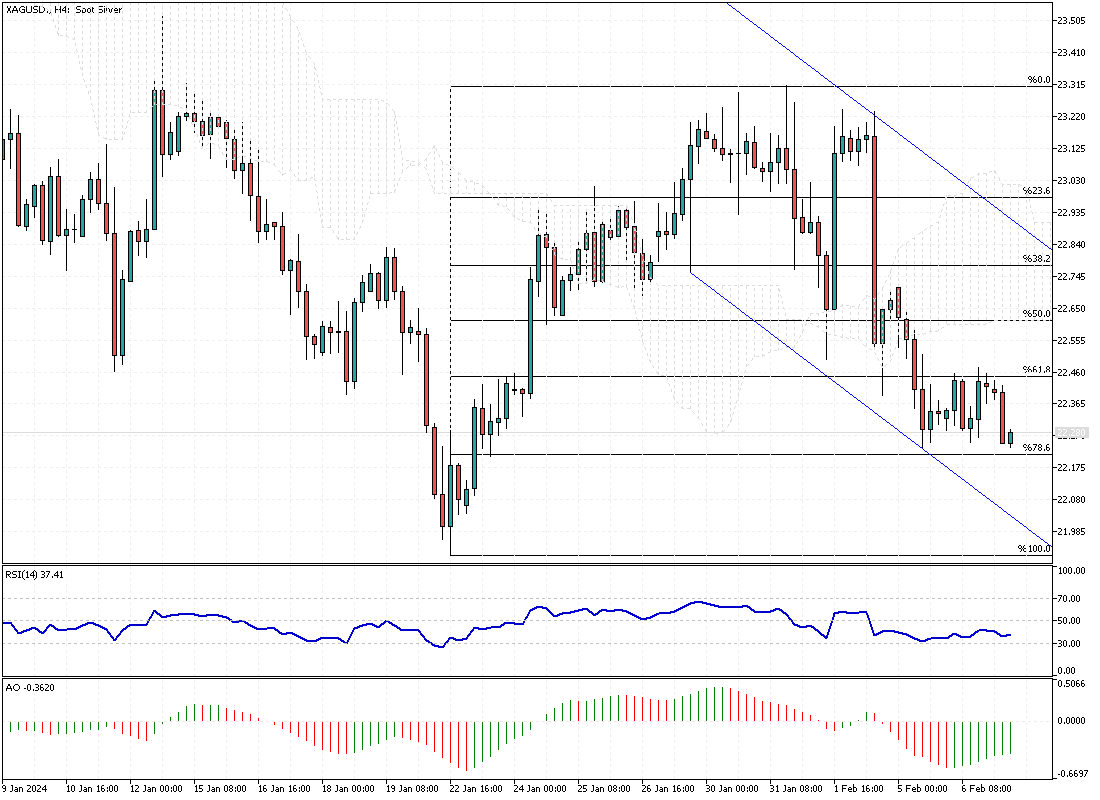

Silver Analysis – February-7-2024

Silver‘s value took a significant hit, dropping to about $22.5 per ounce, marking its lowest point in over a week. This shift came as investors reassessed their expectations for when and how much the Federal Reserve might lower interest rates.

This change in perspective was primarily spurred by a recent report on U.S. job growth, which showed the economy adding 353,000 jobs in January—nearly double the 180,000 jobs economists had predicted and an increase from December’s revised figure of 333,000 jobs. With the unemployment rate holding steady at 3.7%, contrary to the expected rise to 3.8%, and wages rising, the financial community now expects fewer rate cuts by the end of 2024, a sharp adjustment from earlier predictions.

The Impact of Economic Indicators on Silver

The robust job growth and steady unemployment rate signal a strong labor market in the U.S., affecting how investors view silver and other non-yielding assets. Higher interest rates make it more expensive to borrow money, which can reduce the attractiveness of investing in metals like silver that don’t offer returns through dividends or interest.

As the market adjusts its expectations for rate cuts from the Fed, now anticipating only 127 basis points of reductions by the end of 2024—down significantly from the more than 160 basis points expected earlier—silver’s allure diminishes further. This recalibration reflects a broader assessment of the economy’s strength and the likely direction of monetary policy.

Silver and the Global Economic Landscape

A less optimistic outlook for industrial demand adds to silver’s challenges, especially considering the International Monetary Fund’s (IMF) predictions of a slowdown in China, one of the metal’s most significant consumers. This gloomier forecast for one of the world’s largest economies can dampen demand for silver, widely used in various industrial applications. The interconnectedness of global markets means that economic trends in one major economy can have ripple effects, influencing commodity prices worldwide.

As investors digest these developments, the landscape for silver and other precious metals continues to evolve, shaped by economic indicators, monetary policy expectations, and global demand shifts. This complex interplay of factors underscores the importance of staying informed about global economic trends for anyone involved in commodity markets or considering investments in precious metals.