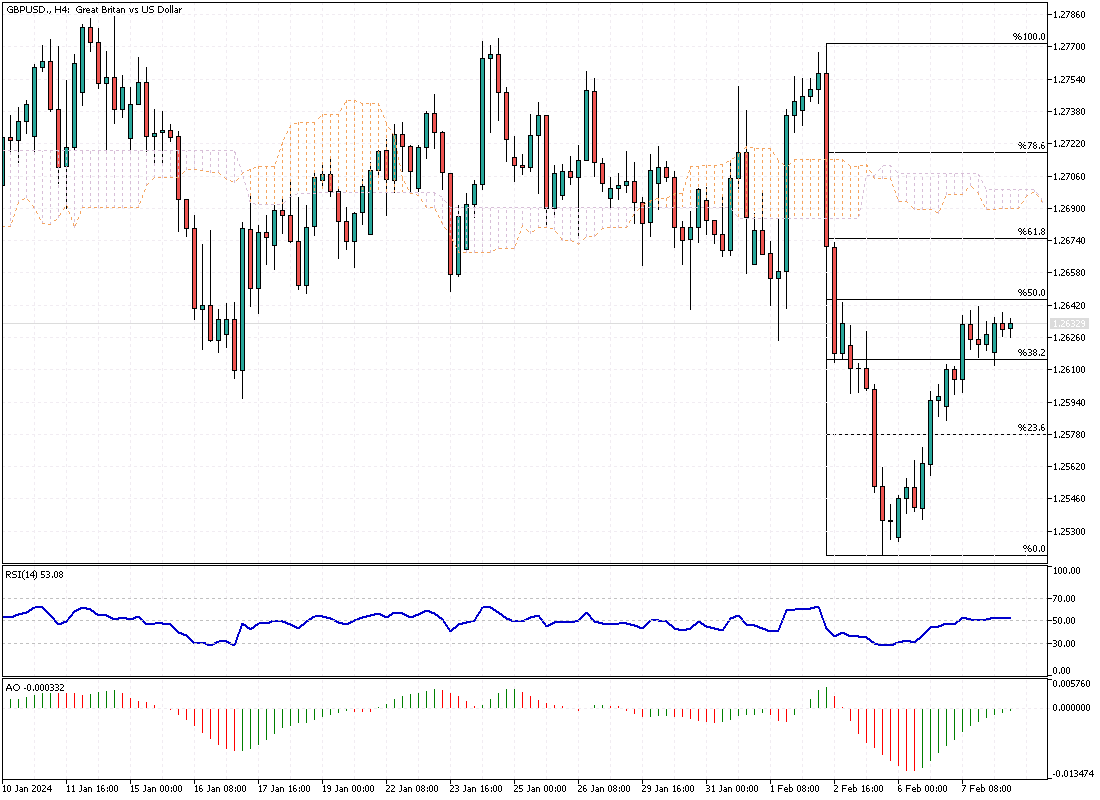

GBPUSD Analysis – February-8-2024

GBPUSD – The British pound has found some stability, hovering around $1.26 from its recent seven-week low at $1.2515. This comes as the dollar gains strength globally, leading investors to rethink their expectations for cuts in US interest rates. Similar shifts are seen in the UK as these global trends influence the pound. Expectations for the Bank of England’s early interest rate reduction have cooled down after comments from Chief Economist Huw Pill.

Pill mentioned that a rate cut is not immediately on the horizon, suggesting it’s a question of timing rather than certainty. Despite this, UK interest rates remained at their peak in nearly 16 years as of February, with a divided vote among policymakers.

Interest Rate Expectations: A Closer Look

Investor sentiment has been notably influenced by Huw Pill’s remarks, leading to a cautious stance on the immediate future of interest rates in the UK. While the Bank of England held rates steady, the decision revealed a significant split among its members, highlighting differing views on the economic path forward.

Two members favored increasing rates further, whereas one saw the need for a reduction. This division underscores the uncertainty and varied perspectives on financial health and inflationary pressures within the UK.

Market Predictions and Future Moves

Looking ahead, financial markets are attempting to forecast the next moves by major central banks. According to money markets, there’s a more than 50% chance that the Federal Reserve will lower rates by May, with the Bank of England expected to follow in June.

These predictions add another layer to the complex landscape of global finance, reflecting the ongoing adjustments and expectations in response to economic signals. These developments affect currency values and influence global investment strategies and financial forecasts as they unfold.