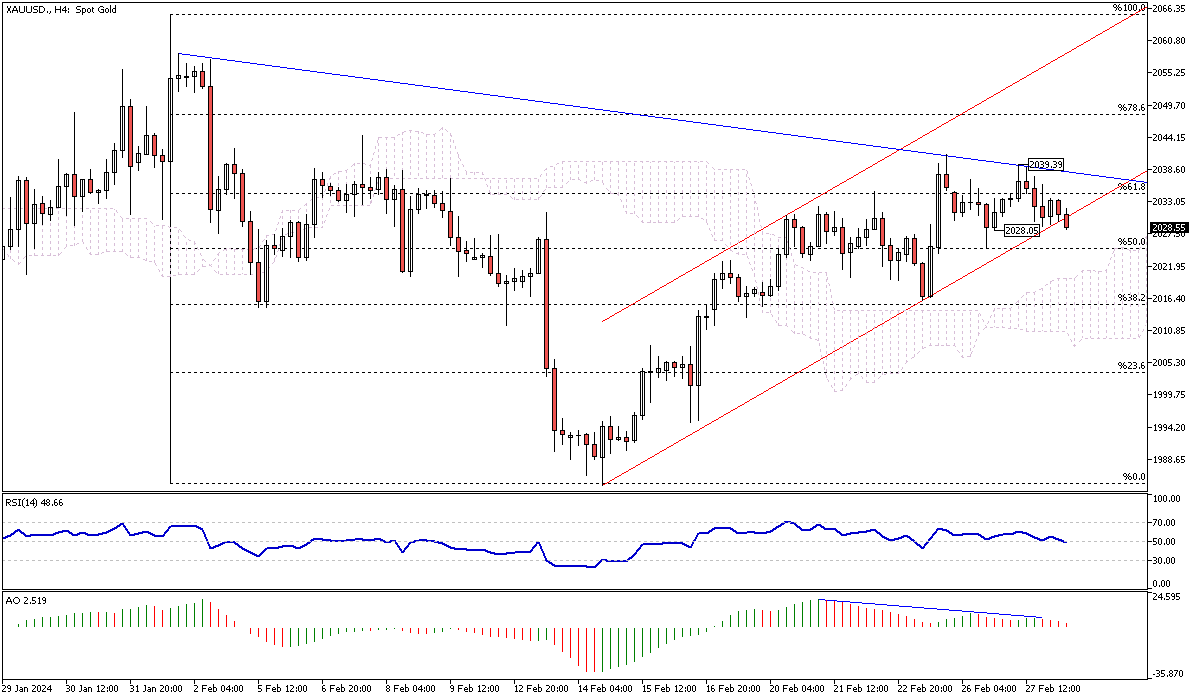

Gold Analysis – February-28-2024

Gold Analysis – As of Wednesday, the price of gold has been relatively stable, hovering around the $2,030 mark per ounce. A lack of significant movement has marked this week as traders and investors await critical economic indicators.

Key among these is the US inflation report, scheduled for release on Thursday, which could significantly impact the Federal Reserve’s future monetary decisions. This anticipation stems from the inflation data’s potential to shape the central bank’s approach to interest rates, influencing the investment landscape, particularly for gold, often seen as a hedge against inflation.

Gold Analysis: Economic Indicators and Market Sentiment

The market’s focus is not only on the upcoming inflation data but also on other critical economic metrics. The forthcoming release of the monthly personal consumption expenditures price index, regarded as the Federal Reserve’s favored inflation measure, is highly anticipated. Additionally, investors are poised to analyze the second estimate of the US Gross Domestic Product (GDP) figures, set to be disclosed later on the same day.

These figures are essential as they provide deeper insights into the overall health and trajectory of the US economy. Moreover, the investment community closely monitors speeches from various Federal Reserve officials throughout the week, seeking hints about future monetary policies. Current market consensus leans towards the expectation that the Federal Reserve will maintain the status quo regarding interest rates in the upcoming March and May sessions. However, speculative chatter remains about a potential rate cut in June, reflecting the markets’ ongoing attempts to forecast and adapt to possible economic shifts.

Global Economic Perspectives

In a broader context, international economic developments also play a crucial role in shaping market sentiment and investment strategies. Notably, Australia has recently reported inflation figures for January that fell short of market expectations, indicating a possible cooling in price pressures. This development could influence global commodity markets, including gold. Simultaneously, the Reserve Bank of New Zealand’s decision to keep interest rates unchanged and a less aggressive stance on future monetary policy than many had anticipated adds another layer of complexity to the global economic landscape.

These international economic signals are significant as they contribute to the broader narrative affecting market dynamics and investor strategies, particularly in the context of gold investment and the ongoing evaluation of global monetary policies.