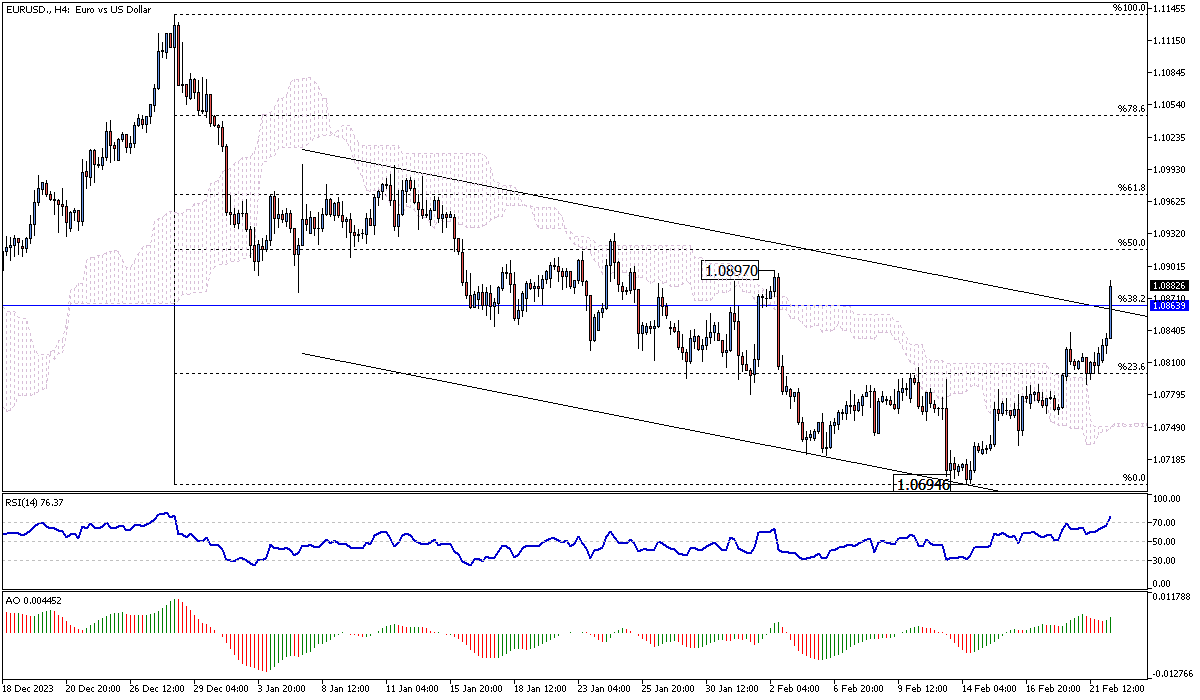

EURUSD Analysis – February-22-2024

The Euro has seen a notable rise, surpassing the $1.08 mark for the first time since early February. This surge is entirely due to the dollar’s diminishing strength, alongside investor analysis of recent data that shows a slowdown in the Eurozone’s wage growth. This shift comes amid restrained remarks from several European Central Bank (ECB) officials.

The decreasing wage growth rate, from a record high of 4.7% to 4.5% in the last quarter, aligns with the market’s anticipation. While wage increases have seemingly reached their zenith, they continue to stand well above the rate that aligns with the ECB’s 2% inflation target.

ECB’s Wage Growth Observation and Monetary Policy

The ECB’s latest data release has shed light on the current economic landscape, revealing a deceleration in negotiated wage increases across the Eurozone. This change significantly indicates the region’s financial health and inflationary pressures. ECB President Christine Lagarde has preferred to delay any rate adjustment decisions until the first-quarter wage agreements are fully assessed.

This approach reflects a broader trend among ECB policymakers cautious about monetary policy adjustments, indicating potential rate cuts within the year but without committing to a fixed schedule.

EURUSD Analysis: Market Reactions

Investors and market analysts closely monitor these developments, especially the ECB’s cautious approach towards easing monetary policies. The anticipation of rate cuts and the current state of wage growth play a crucial role in shaping market dynamics and investment strategies in the Eurozone. The careful balance between controlling inflation and supporting economic growth is at the forefront of the ECB’s agenda.

As policymakers navigate through these economic indicators, the future of the Eurozone’s monetary policy remains a focal point for investors, with implications for the Euro’s valuation and the broader financial market.