RBA Cautious Approach and its Impact on AUDUSD

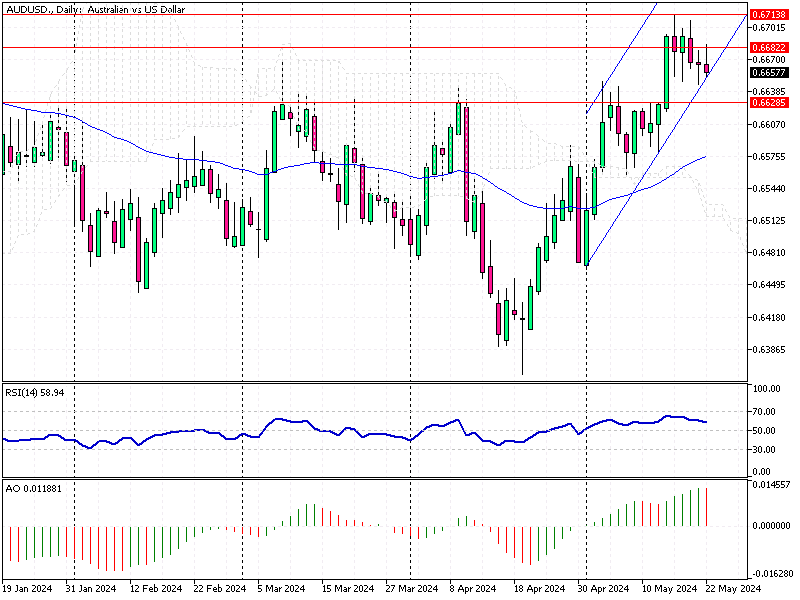

The Australian dollar eased to around $0.666 (AUD/USD), moving away from four-month highs. This shift comes as investors continue to assess the outlook for the Reserve Bank of Australia’s (RBA) monetary policy.

RBA Cautious Approach and its Impact on AUDUSD

The latest RBA meeting minutes revealed that the board considered raising rates in May but ultimately chose to keep the policy steady. The board found it challenging to either rule in or rule out future changes in the cash rate. They noted that recent data had increased the risk of inflation staying above target for longer.

Economic Data Influences Market Sentiment

Recent data has added to the cautious sentiment. Last week, Australia’s unemployment rate increased to 4.1% in April from 3.8% in March. This rise in unemployment was more than expected and followed data showing that domestic wage growth unexpectedly slowed in the first quarter.

Market Expectations and Future Outlook

These economic indicators have led markets to believe that further interest rate hikes from the RBA are unlikely soon. Traders and investors should closely monitor upcoming data releases and RBA statements for any hints of policy changes.

In conclusion, the current economic environment and the RBA’s cautious stance are key factors influencing the Australian dollar. Staying informed and ready to adjust strategies based on new data will be crucial for traders and investors in navigating these uncertain times.