GBPUSD Falls – Interest Rate Cuts Amid Slow Spending

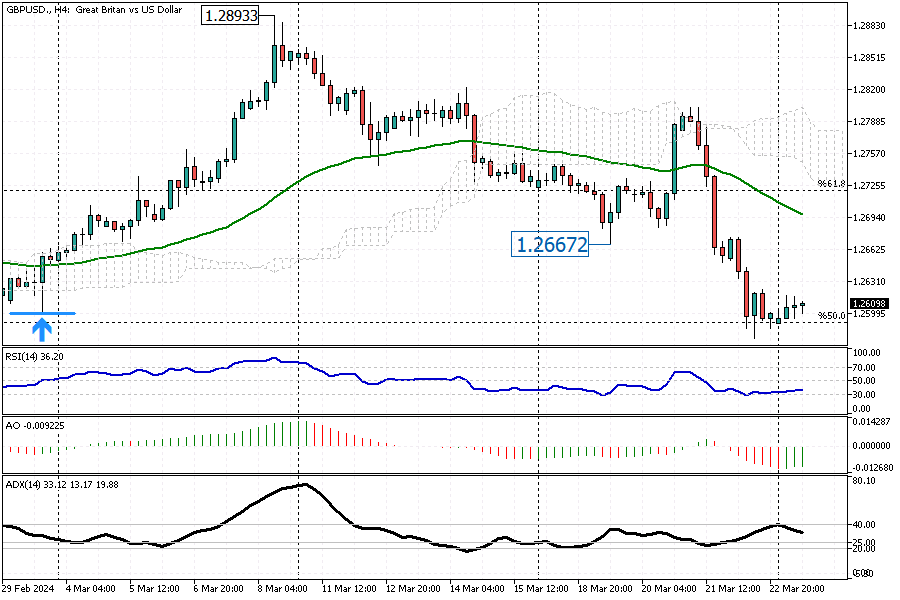

GBPUSD Analysis – The UK’s pound currency dropped to about $1.26, its lowest since February 19th. This happened as people in the UK stopped spending more in February, and the head of the Bank of England, Andrew Bailey, suggested that interest rates might be lowered this year. The Office for National Statistics reported no change in UK retail sales in February, which was surprising compared to the big 3.6% jump in January and opposite to the expected 0.3% fall.

Additionally, Bailey mentioned signs of falling inflation but stressed the importance of being more sure before easing the pressure on prices. The Bank of England decided to keep the interest rates steady at a 16-year peak of 5.25% with an 8-1 vote. This was after two members changed their minds about wanting higher rates. The bank’s decision comes as recent figures show a drop in inflation, reaching its lowest in over two years but still higher than its goal.