AUDUSD Analysis – December-14-2023

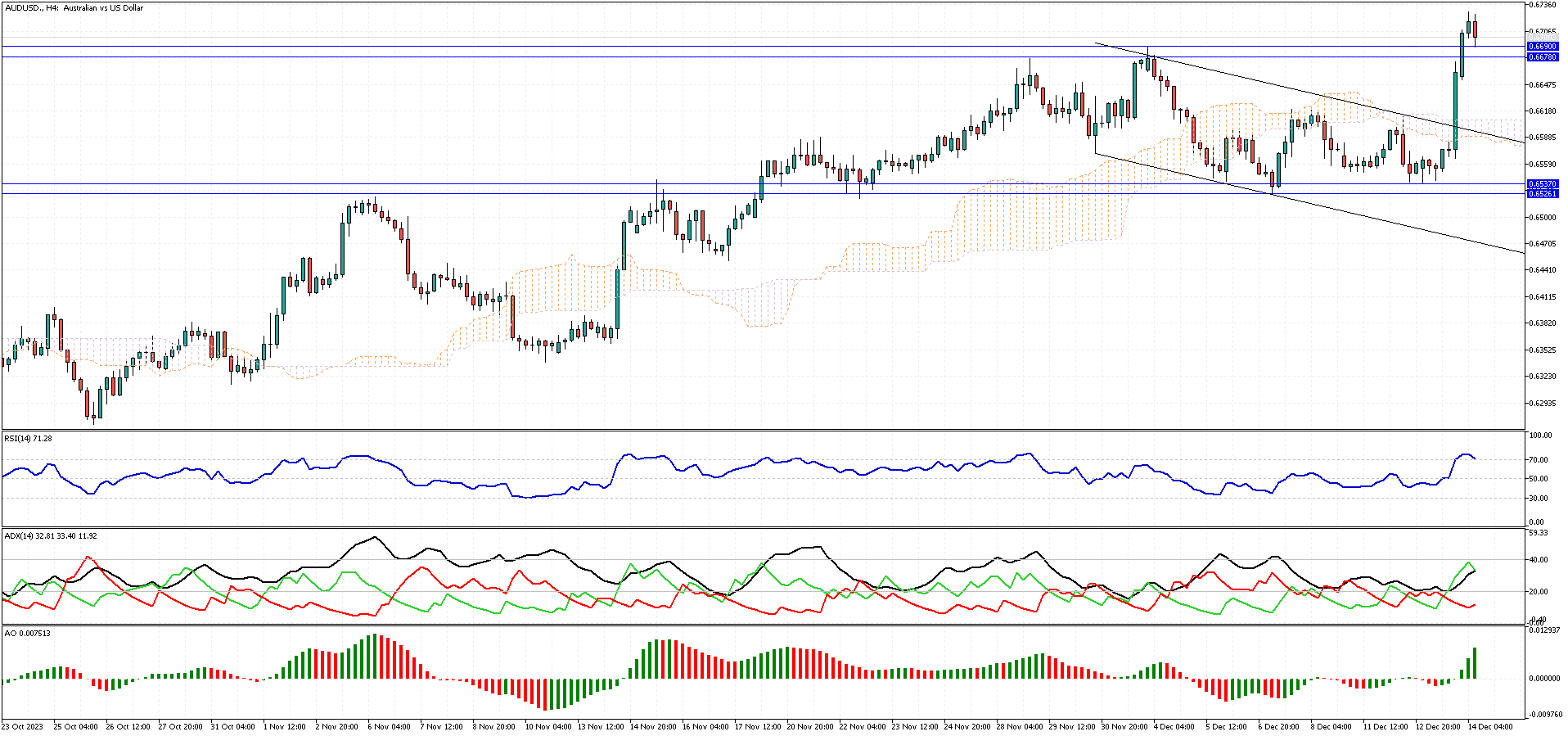

Our previous technical analysis discussed the bullish signals emerging for the AUDUSD pair. The AUDUSD price has recently made a notable move by successfully breaking above the Ichimoku cloud, influenced by the Federal Reserve’s dovish stance on interest rates. Currently, the AUDUSD pair is testing the recently broken resistance zone between 0.6678. Significantly, the Relative Strength Index (RSI) indicates an overbought condition. This suggests a potential consolidation phase, hinting that the price might stabilize above the 0.6678 level.

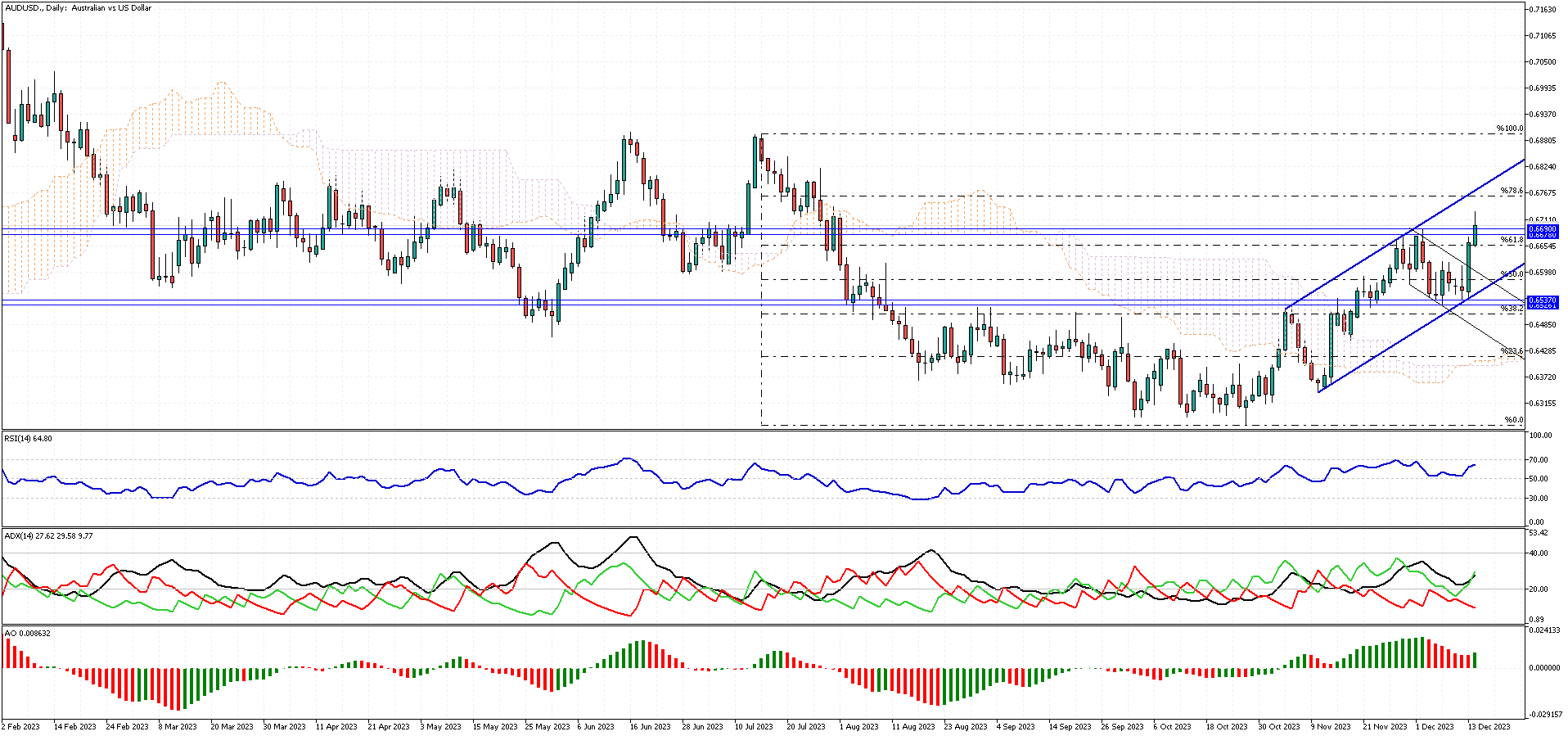

Looking at the bigger picture on the daily chart, we can see that the AUDUSD pair is trading within a bullish channel. This observation leads us to believe that the next target for the AUDUSD bulls could be the 78.6% Fibonacci resistance level. It’s crucial to note that the primary trend continues to be bullish as long as the pair remains within this trading channel.

US Rate Cuts Drag Down Australia’s 10-Year Bond Yield

Bloomberg – Australia’s 10-year government bond yield dropped to nearly 4.1%, reaching its lowest point in almost three months. It followed a steep fall in US bond yields after the Federal Reserve kept interest rates unchanged and announced three rate cuts for 2024. Meanwhile, in Australia, data revealed that the unemployment rate rose slightly to 3.9% in November from 3.8% in October. Also, consumer inflation expectations in December fell to the lowest level in two years.

Regarding monetary policy, Reserve Bank of Australia Governor Michele Bullock stated that the central bank was careful with monetary policy and would monitor the incoming data. She also said that Australia was not lagging in the fight against inflation. However, markets expect that the RBA has stopped tightening and anticipate a slower inflation recovery in Australia than in other major economies.