GBPJPY Technical Analysis: Uptrend Continues

Reuters — On Monday, Japan’s stock market witnessed a slight downturn, with the Nikkei 225 Index dropping 0.53% to 33,447 and the broader Topix Index decreasing 0.38% to 2,382. This decline halted a two-day streak of gains, as investors turned their attention to upcoming economic data in Japan, which is expected to influence both economic and monetary policy decisions.

Recent Economic Indicators

Last week’s data revealed an acceleration in Japan’s headline inflation rate, reaching 3.3% in October, up from 3% in September. This marks the highest inflation rate since July. Additionally, preliminary reports indicated a slowdown in business activity to an 11-month low in November, particularly due to continued challenges in the manufacturing sector.

Impact on Major Companies

Several prominent companies in the index experienced notable losses. Mitsubishi Heavy Industries saw a significant drop of 5%, while Toyota Motor decreased by 1.2%. Other major players such as SoftBank Group, Keyence, and Disco Corp also faced declines, with their shares falling by 1.7%, 1.9%, and 1.3%, respectively.

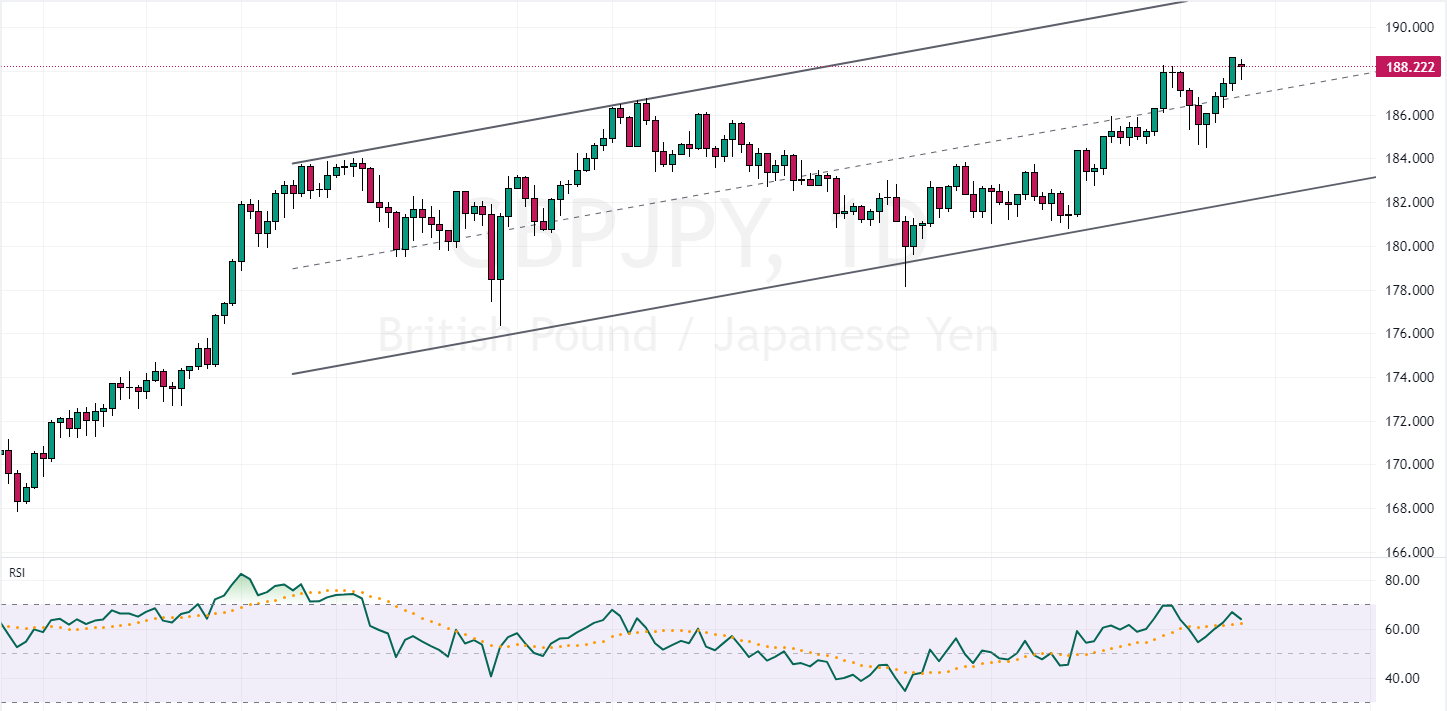

GBPJPY Technical Analysis

In today’s trading session, the GBPJPY pair continued its bullish trend, successfully crossing above the median line of the bullish flag. This movement underscores a positive outlook for the GBPJPY trend, with the bulls now focusing on reaching the upper line of the bullish flag.

GBPJPY Technical Analysis – 4H Chart

The main GBPJPY trend remains bullish as long as the pair continues to range within the confines of the bullish flag.