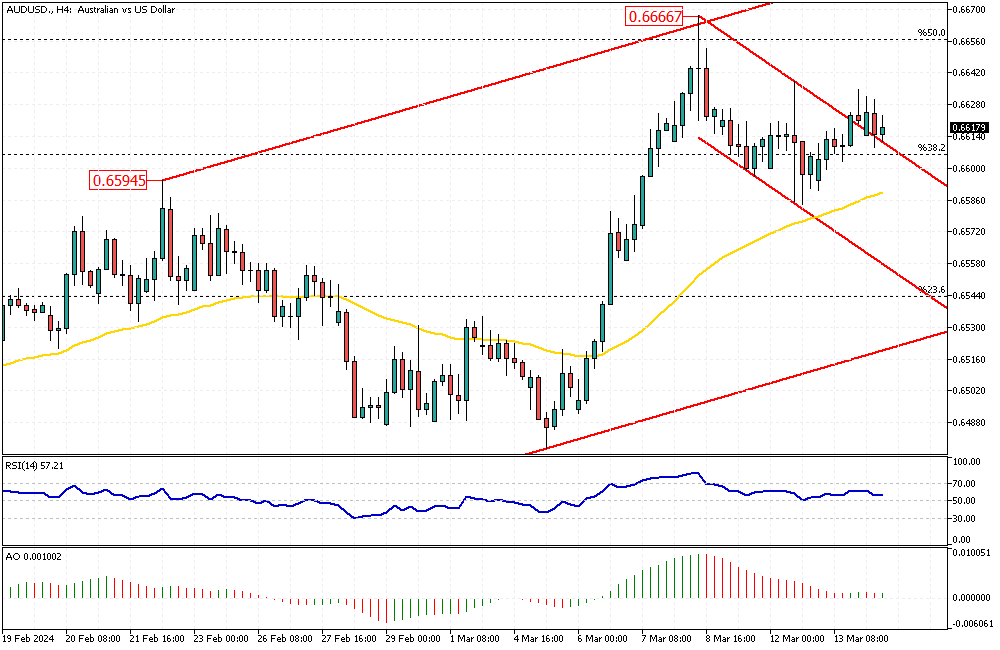

AUDUSD Analysis – March-14-2024

AUDUSD Analysis – The Australian dollar is currently weak, staying around $0.66. This is because the US released strong inflation data, making people unsure when the US Federal Reserve will reduce interest rates. However, the Aussie dollar still has some support. Investors think the US will ease its monetary policy sooner than other major banks. Simply put, the Australian dollar isn’t doing great, but it’s not all bad news either.

Australia’s Economic Slowdown

Australia’s economy didn’t grow as much as traders thought it would in the last part of the year. This news makes some believe that the Australian central bank might lower interest rates sooner than expected. If the bank cuts rates, it could help the economy, but it shows that things aren’t going as well as hoped.

Right now, the market strongly believes that the Reserve Bank of Australia (RBA) will lower its rates by August, with a total expected decrease of 45 basis points this year.

AUDUSD Predictions and Market Responses

After reviewing Australia’s recent weak economic performance, the Commonwealth Bank of Australia considers the central bank will cut rates more than others expect. They predict a total reduction of 75 basis points for the year. This means they believe the Australian economy needs more help than initially thought.

This forecast affects investors and the overall market, showing a more cautious approach towards Australia’s economic future.