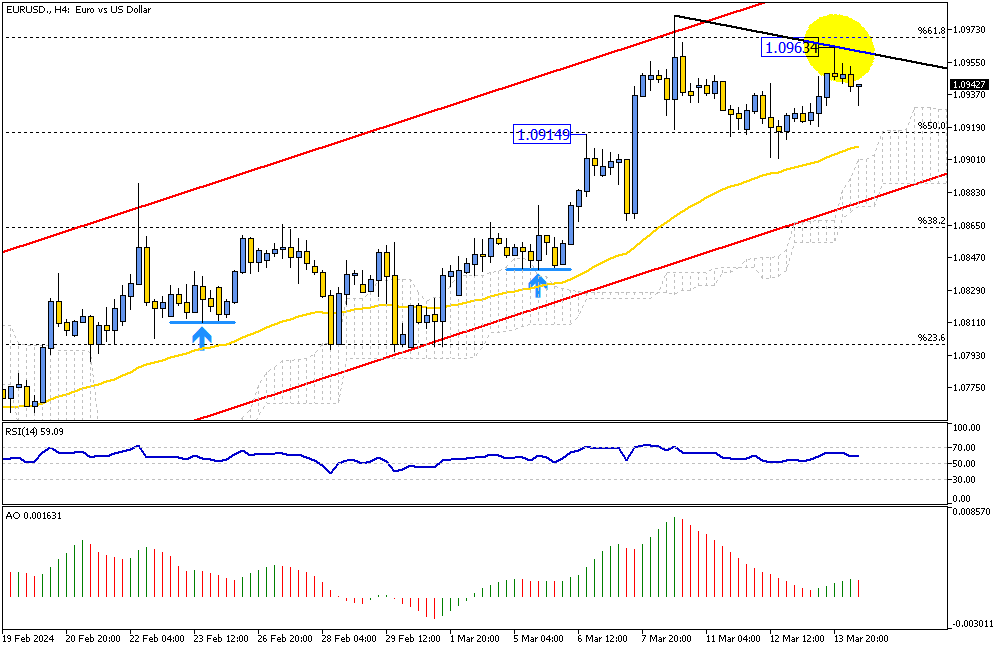

EURUSD Analysis – March-14-2024

EURUSD Analysis – The Euro is trading near $1.09, a peak it hasn’t reached in roughly two months. This increase is partly due to the U.S. dollar becoming weaker. Additionally, weaker U.S. dollars are looking closely at future decisions regarding interest rates. They expect changes might happen soon, particularly a decrease in rates. The expectation is that these lower rates could begin in June.

Interest Rate Expectations in Europe and the U.S.

The Federal Reserve (Fed) and the European Central Bank (ECB) have hinted that cuts in interest rates might be on the horizon. Investors are betting that these reductions will start in June. Similarly, many ECB leaders are targeting June to begin lowering rates.

It’s predicted that the ECB might reduce the cost of borrowing by about one percentage point throughout 2024. This means loans could become cheaper, encouraging spending and investment.

ECB’s Monetary Policy and Inflation Outlook

In its recent meeting held in March, the ECB decided to keep borrowing costs high, a move aimed at controlling inflation. However, they’ve made notable progress in reducing the rate of price increases. The ECB is optimistic while prices continue to rise due to high wages and other factors.

It has adjusted its inflation forecast downwards, predicting a rise of 2.3% this year. They expect it to decrease to 1.9% by 2025, indicating a positive trend towards stabilizing prices.