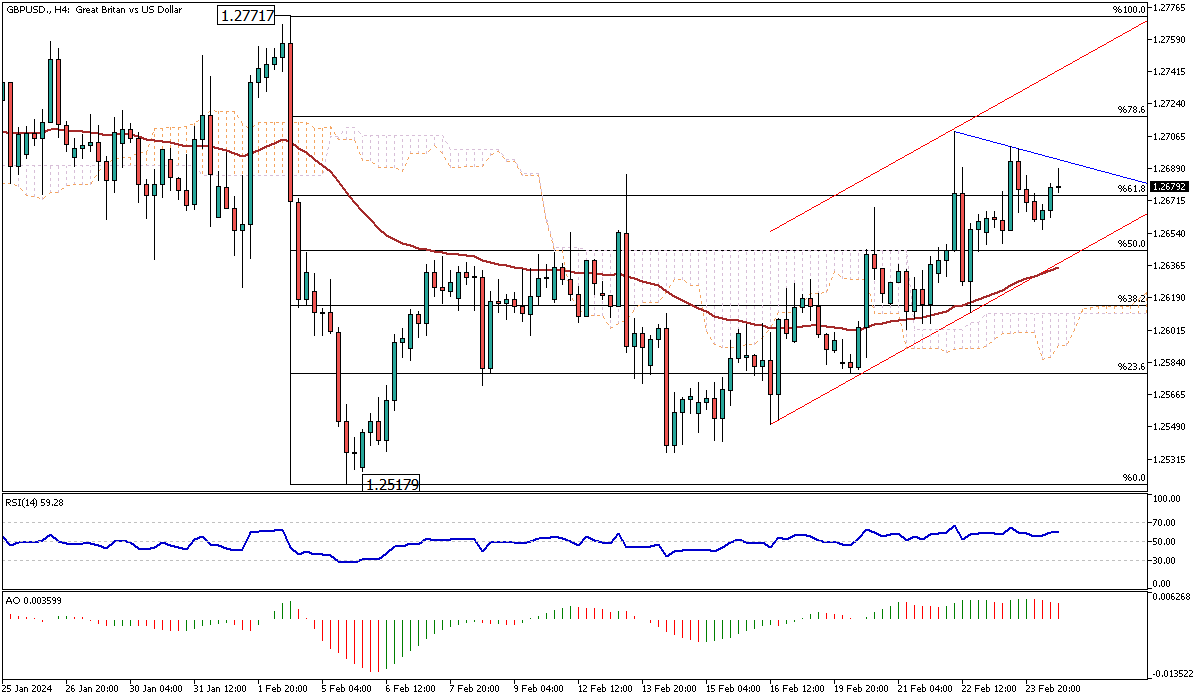

GBPUSD Analysis – February-26-2024

GBPUSD Analysis – The British pound has strengthened significantly, maintaining its position well above the $1.265 threshold. This marks its highest point since the beginning of February. This upward movement comes as traders and investors reassess their expectations for the Bank of England’s monetary policies.

This shift in perspective was sparked by recent updates in British economic indicators, particularly the PMI data, suggesting a more robust economic landscape than previously anticipated.

Insights from Recent Economic Indicators

Recent data indicates that the UK’s private sector is experiencing a robust expansion, which has not been seen since May of the previous year. The growth is primarily fueled by an impressive service sector performance, exceeding analysts’ forecasts. This unexpected uptick provides a clear signal of underlying economic strength, potentially influencing future policy decisions by the Bank of England.

The data underscores the dynamic nature of the UK economy, with the service sector playing a pivotal role in its recovery and expansion.

Inflation Concerns and Monetary Policy Implications

Amid these positive developments, there are emerging concerns over inflation, primarily due to significant wage increases within service-related businesses and ongoing supply chain disruptions, particularly those affected by geopolitical tensions in the Red Sea area. These factors contribute to a complex economic scenario that could prompt the Bank of England to maintain a cautious stance regarding any adjustments to borrowing costs.

The central bank’s approach will be critical in the coming months as it navigates between fostering economic growth and controlling inflationary pressures. This delicate balance will sustain the UK’s financial stability and growth trajectory.