GBPUSD Gains Ground Amid UK Inflation Eases

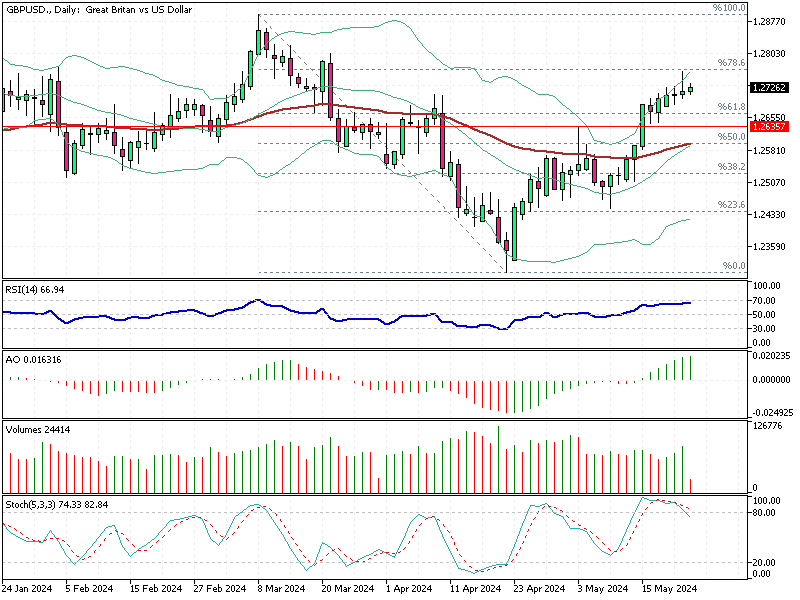

The British pound has surged to $1.275 (GBP/USD), marking its highest value in two months. This rebound comes after a period of volatility as traders weigh the future policies of the Bank of England (BoE) and the political climate in the UK. Understanding these changes can help forex traders make better decisions in this dynamic environment.

GBPUSD Gains Ground Amid UK Inflation Eases

Bloomberg—In April, the UK’s annual inflation rate eased to 2.3%. This brings it closer to the BoE’s target of 2%, though it remains slightly above the forecast of 2.1%. Additionally, core inflation has decreased for the third month to 3.9%, the lowest since October 2021, yet still above the expected 3.6%. These figures indicate a mixed economic outlook, influencing the pound’s recent strength.

BoE Policy: What to Expect

The BoE’s policy outlook is crucial to the pound’s performance. Despite the recent data, investors have almost ruled out a reduction in borrowing costs in June. However, a slight majority expect the first cut to occur in September. This anticipation of future policy shifts contributes to the pound’s current strength as traders adjust their strategies accordingly.

Political Uncertainty and Its Impact

Adding to the economic factors, political uncertainty is also in play. Prime Minister Rishi Sunak has announced national elections for July 4th. Polls suggest a potential change in government to the Labour Party, which introduces additional risks and uncertainty. Such political changes can significantly impact the UK’s economic policies and, consequently, the forex market.

Critical Takeaways for Forex Traders

Easing inflation, the BoE’s policy stance, and upcoming political changes create a complex landscape for forex traders. Monitoring these developments is essential for making informed trading decisions. As the British pound reacts to these factors, staying updated will help traders navigate the market more effectively.