USDJPY Analysis – 11-June-2024

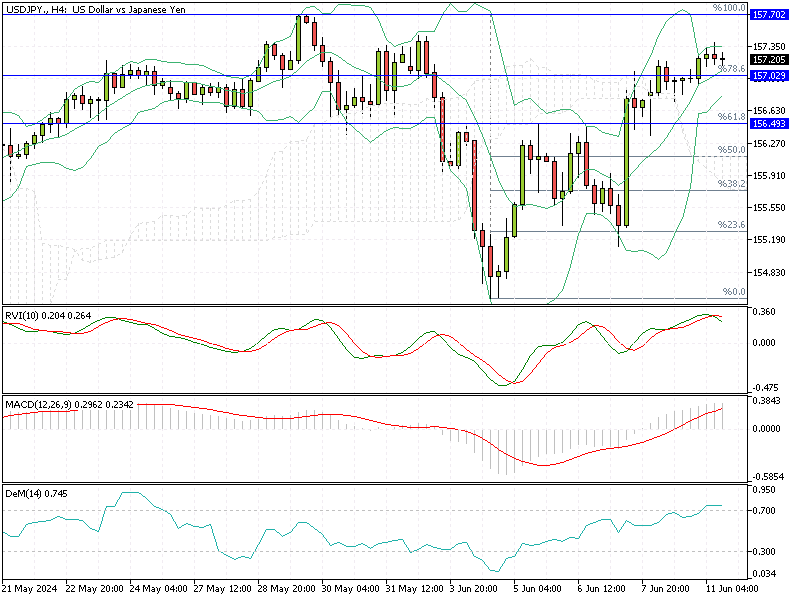

The U.S. Dollar is trading robustly against the Japanese Yen, currently positioned above the 78.6% Fibonacci retracement level at approximately 157.2. This suggests a strong bullish trend. However, technical indicators such as the Demarker, above 0.7, signal that the market may be overbought.

The USD/JPY pair might soon consolidate to lower resistance levels.

USDJPY Analysis – 11-June-2024

Trading Opportunity in the Consolidation Phase

Analyzing the 4-hour chart, we notice the Bollinger Bands are narrowing. This indicates a range-bound market, consistent with the Demarker’s signal. Essentially, this suggests that the bullish momentum may be slowing down.

Technically, the U.S. Dollar seems overpriced, while the USD/JPY is in a bull market. The price could dip below the immediate support at 157.0, leading to further consolidation toward the 61.8% Fibonacci level at 156.4. For traders, this presents a good opportunity to enter the market.

Bulls Eye Key Resistance at 157.7 for Breakout

Conversely, the key resistance level stands at 157.7. If the bulls break through this level, the uptrend will likely continue, potentially targeting the April high of 160.2.

Summary

In summary, while the current trend is bullish, market signals suggest a potential for consolidation. Monitoring these key levels can help traders make informed decisions.