USDCAD Analysis – Cad Slips as Fed Signals Hawkish

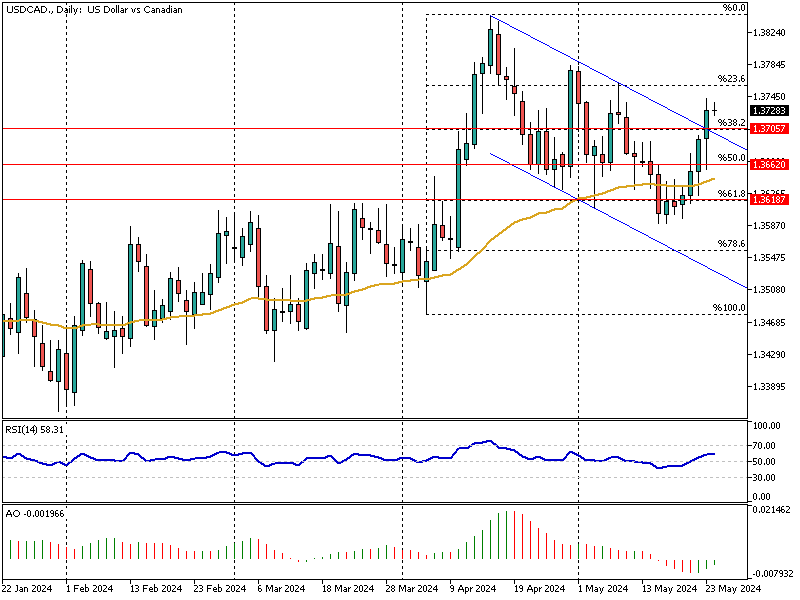

USD/CAD Analysis—The Canadian dollar weakened towards $1.372, moving further away from the five-week highs earlier in the month. This decline was driven by a stronger greenback, bolstered by hawkish sentiment from the Federal Reserve.

USDCAD Analysis – Cad Slips as Fed Signals Hawkish

Recent Fed minutes revealed heightened concerns among FOMC members about persistent inflationary pressures in the US economy. This has led to a readiness for additional monetary tightening measures, if necessary, strengthening the US dollar against the Canadian dollar.

Domestically, the Bank of Canada (BoC) is facing different pressures. Recent inflation data suggested that the BoC might be ready to cut interest rates next month. April’s headline inflation slowed to 2.7%, a three-year low, and the core rate fell to 1.6%, its lowest since 2021.

Market Positioning for Rate Cuts

Interest rate futures show that roughly half of the market has positioned itself for a BoC rate cut in June. This expectation influences the forex market, contributing to the Canadian dollar’s weakness against the US dollar.