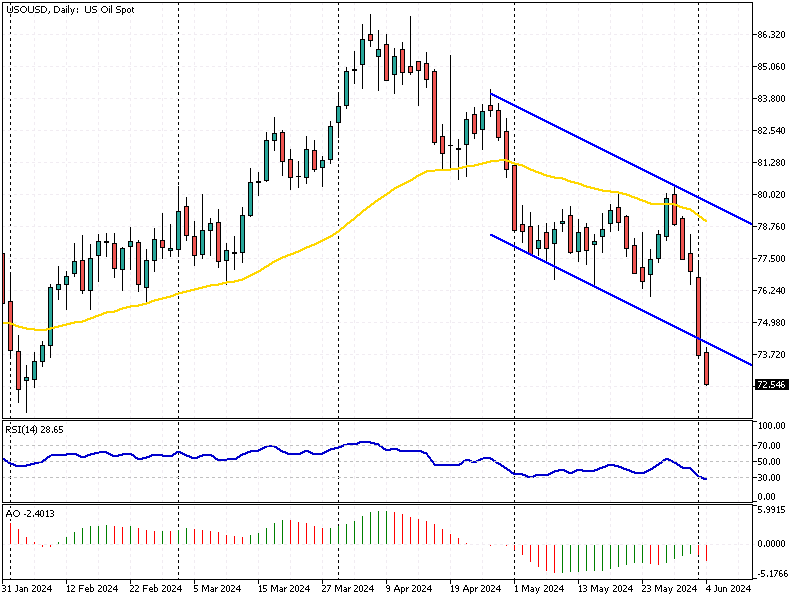

WTI Crude Oil Analysis – 4-June-2024

On Tuesday, WTI crude futures dipped below $73 per barrel, significantly declining for the fifth consecutive session. This price drop is the lowest in four months, driven by concerns over a potential increase in global oil supply later this year.

WTI Crude Oil Analysis – 4-June-2024

OPEC+ Eases Oil Cuts for 2025

Recent decisions by OPEC+ have played a pivotal role in this scenario. Although the organization has extended most of its supply cuts into 2025, it has gradually allowed eight member countries to unwind their voluntary cuts starting in October.

This change is expected to bring over 500,000 barrels daily back into the market by December, with 1.8 million barrels per day anticipated by June 2025.

US Economic Signals Lower Oil Prices

Additionally, economic signals from the United States, the world’s largest oil consumer, have contributed to the downward pressure on oil prices. US manufacturing activity saw further contraction in May, indicating economic weakness.

This slowdown and concerns that the US Federal Reserve might not reduce interest rates this year have fueled fears of slower economic growth and diminished oil demand.

Summary

Understanding these dynamics is crucial for consumers and businesses. Monitoring OPEC+ policies and US economic indicators can help make informed decisions about energy consumption and investments in the oil market.