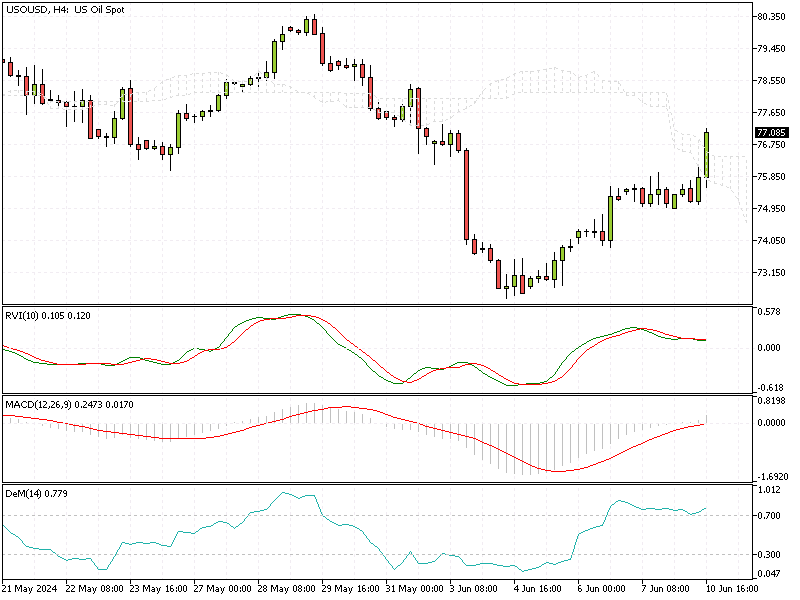

WTI Crude Oil Analysis – 10-June-2024

FxNews—WTI crude futures have seen a notable increase of over 1%, pushing prices above $77 per barrel. This rise is primarily attributed to growing optimism about increased fuel demand during the summer season.

Additionally, anticipation around significant events, such as the Federal Reserve’s upcoming interest rate decision and a significant US inflation report, has fueled market activity.

WTI Crude Oil Analysis – 10-June-2024

WTI Crude Oil Analysis – 10-June-2024

Last week, the scenario was different. Oil prices were under pressure due to robust US jobs data. This data reduced traders’ expectations for potential rate cuts, which shadowed economic growth and energy demand projections. Substantial employment numbers can lead to tighter monetary policy, dampening economic expansion, and lowering energy consumption.

The market is also closely watching political developments in Europe. French President Emmanuel Macron’s call for a snap election, following his party’s loss to Marine Le Pen’s National Rally in the EU elections, has introduced additional uncertainty. Political stability is crucial for economic confidence, and any disruptions can impact commodity markets, including oil.

Another factor influencing oil prices is the strategy of OPEC+. Last week marked the third consecutive weekly loss for oil, driven by concerns over OPEC+’s plans to unwind some production cuts and increase output from October through September 2025. This move could lead to a higher supply in the market, potentially affecting prices.

Summary

In summary, while the current rise in WTI crude futures is encouraging, various factors—ranging from economic data and central bank decisions to political events and OPEC+ strategies—continue to play a critical role in shaping the future of oil prices. Understanding these dynamics can help market participants make more informed decisions.