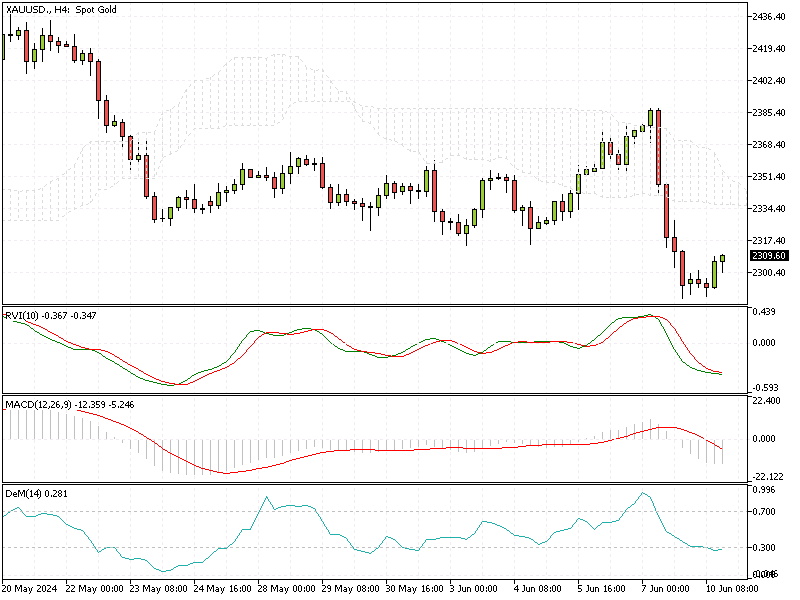

Gold Analysis – 10-June-2024

FxNews—Gold prices have stabilized around $2,309 per ounce on Monday, following a significant 3.5% drop on Friday, marking the largest single-day decline since November 2020.

This dramatic shift has captured traders’ attention, and they are now keenly watching the upcoming Federal Open Market Committee (FOMC) monetary policy decision and the critical US Consumer Price Index (CPI) reading. These indicators are crucial as they influence the Federal Reserve’s timing on its first potential rate cut.

Gold Analysis – 10-June-2024

Gold Analysis – 10-June-2024

Last week’s robust jobs report played a pivotal role in altering investor sentiment, leading many to reassess their expectations for any Fed easing this year. This newfound caution among investors underscores the fragile balance between economic indicators and market responses.

Adding to the bearish outlook for gold, China’s central bank has ceased gold purchases as of May, ending an 18-month streak of consecutive buying. This move is significant as China’s consistent acquisitions have been a critical driver of global gold demand.

Meanwhile, in Europe, political instability is on the rise. The far-right party made notable gains in the European Parliament elections, and French President Emmanuel Macron unexpectedly called for a snap parliamentary election. These developments add layers of uncertainty to the global economic landscape, further influencing market dynamics.

Investors should remain vigilant and closely monitor economic indicators and geopolitical events to navigate this volatile environment effectively.