USDCNH Analysis: Yuan Stability Amid Policy Hold

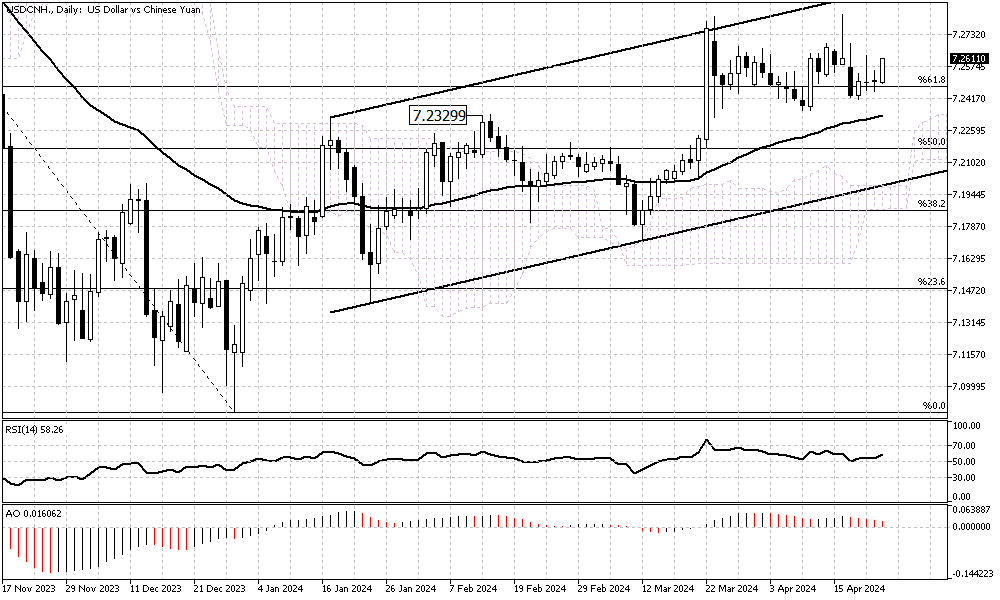

USDCNH Analysis – The offshore yuan is currently hovering around 7.25 per dollar following the recent decisions by the central bank. This stability reflects the investors’ calm response to the unchanged key lending rates.

The one-year Loan Prime Rate (LPR) remains at 3.45%, and the five-year rate is constant at 3.95%. The People’s Bank of China has decided not to alter the benchmark lending rates, a move anticipated by the market. This decision comes as a response to robust economic data from the first quarter of the year, which has lessened the pressure for immediate monetary actions.

Decline in Foreign Investments

China experienced a significant drop in Foreign Direct Investment (FDI) in the first quarter of 2024. The figures fell by 26.1% year-on-year, totaling CNY 301.67 billion. This sharp decrease contrasts with the record-high investment flows from last year. The data suggests that Beijing faces ongoing hurdles in attracting foreign funds, which are vital for economic growth.