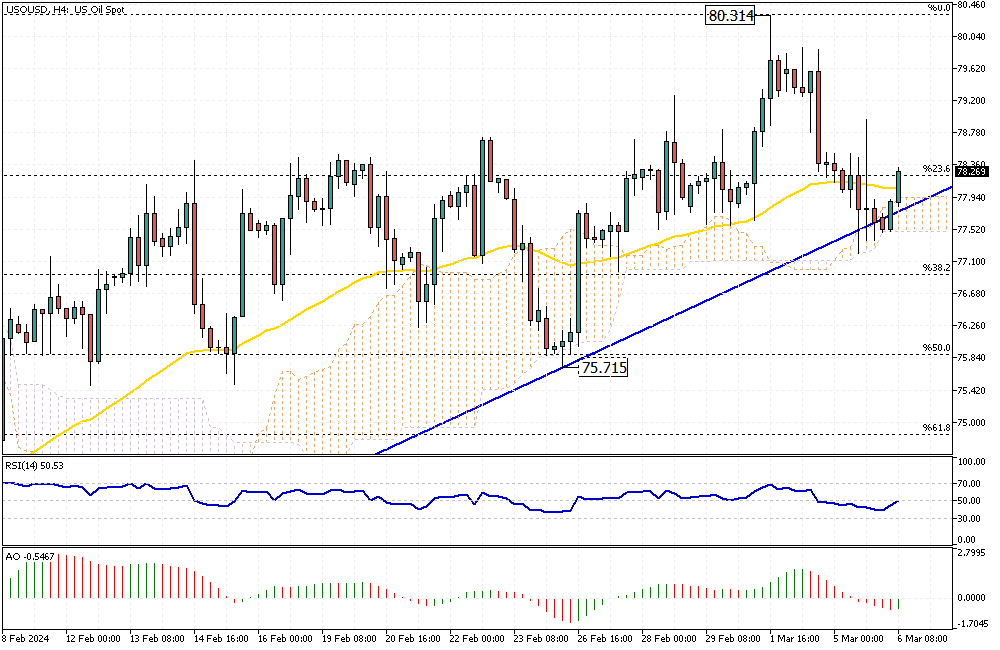

WTI Crude Oil Analysis – March-6-2024

WTI crude futures stayed near $78 a barrel on Wednesday. This stability came despite a drop of over 2% in the last two days. The decrease was due to fears that people might need less oil.

This worry came from seeing weaker signals in the US economy. But, even with less oil being needed, cuts in oil supply by OPEC+ members helped prevent prices from falling further. These mixed signals keep traders cautious.

Economic Indicators: Impact on Oil Demand

Recent data from the US show a slowing down in making things and providing services. This slowdown suggests that America, the top oil-using country, might cut down on how much oil it uses. Also, China, which buys a lot of crude oil, hasn’t promised to boost its economy significantly.

It has only set a modest growth target. These factors make people think global oil demand might decrease, affecting prices.

Global Factors Influencing Oil Prices

Big oil countries like Saudi Arabia, Russia, Iraq, and the UAE have decided to keep producing less oil. They want to ensure there’s not too much oil available, which can lower prices. Also, ongoing issues in the Middle East add to the uncertainty.

These problems can disrupt the oil supply, sometimes increasing prices. So, even with less demand, these production cuts and regional tensions help support oil prices.