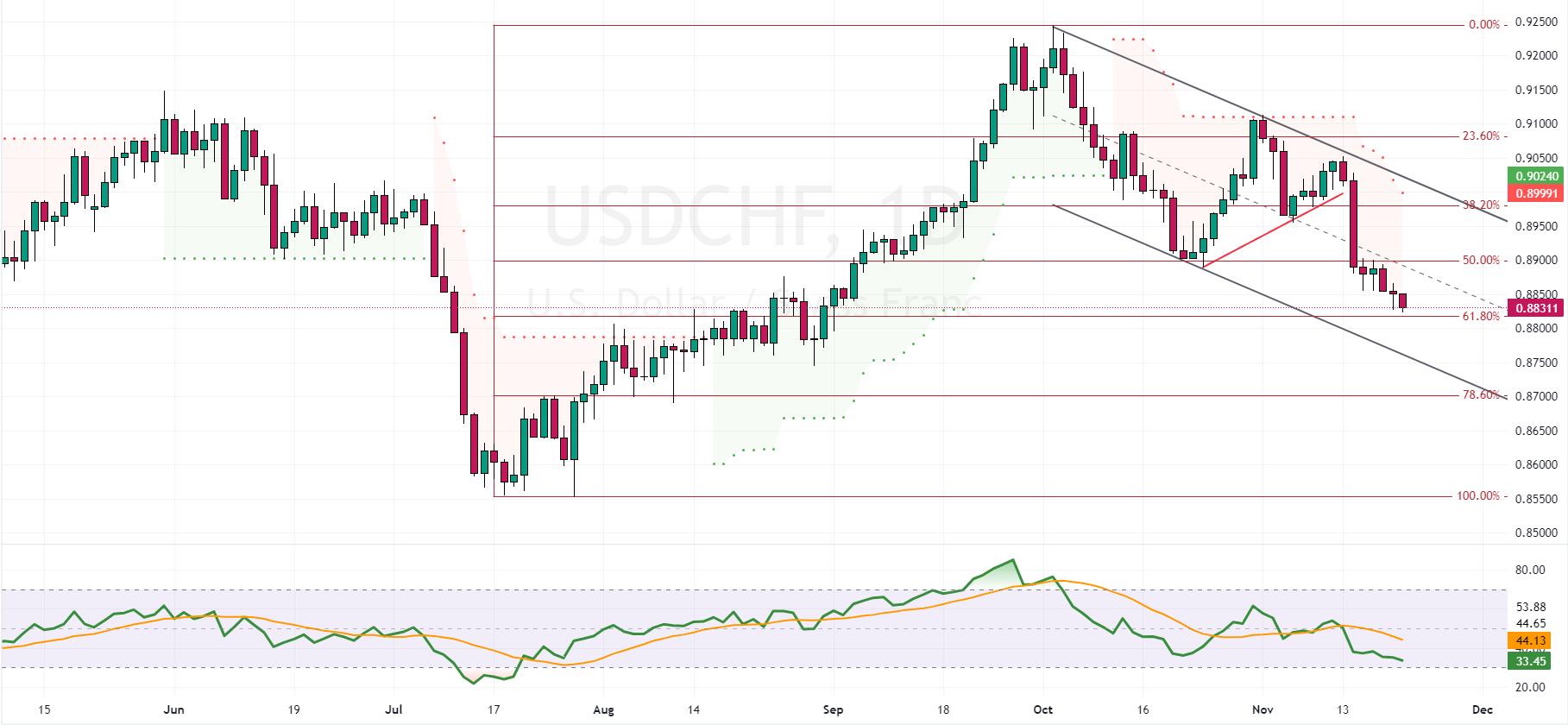

USDCHF Analysis – November-21-2023

In today’s USDCHF Analysis, the currency pair is exhibiting a strongly bearish trend, now approaching the 61.8% Fibonacci retracement level. This level could act as a support, potentially slowing the downward momentum, especially as the RSI indicator is nearing the oversold territory. Should the pair maintain its position above the 61.8% level, USDCHF may enter a correction phase, possibly reaching the 50% retracement level, which presents resistance. Given the current market saturation with short orders, this resistance level could offer a substantial opportunity for bears to initiate new trades.

USDCHF Fundamental Analysis

Reuters – In November, the Swiss franc reached its highest level against the USD in over two months, climbing to 0.88. This surge was primarily driven by the dollar’s weakening following a string of subdued economic indicators. These indicators have fueled speculation that the Federal Reserve may start reducing interest rates by the second quarter of 2024. Meanwhile, restrained inflation and economic slowdown in Switzerland have provided limited support to the franc’s monetary policy. Inflation has consistently stayed under the 2% mark for the fifth month as of October, and recent figures indicate a stagnation in Switzerland’s GDP during the second quarter.

Furthermore, the easing of geopolitical tensions in the conflict between Israel and Gaza has reduced the demand for the franc as a safe-haven currency. This situation led the franc to hover around four-month lows compared to the euro. Nevertheless, despite these factors, the franc is projected to end 2023 stronger against both the dollar and the euro. This strength is primarily attributed to the Swiss National Bank’s reduction of foreign currency reserves, which reached a nearly six-year low in October.