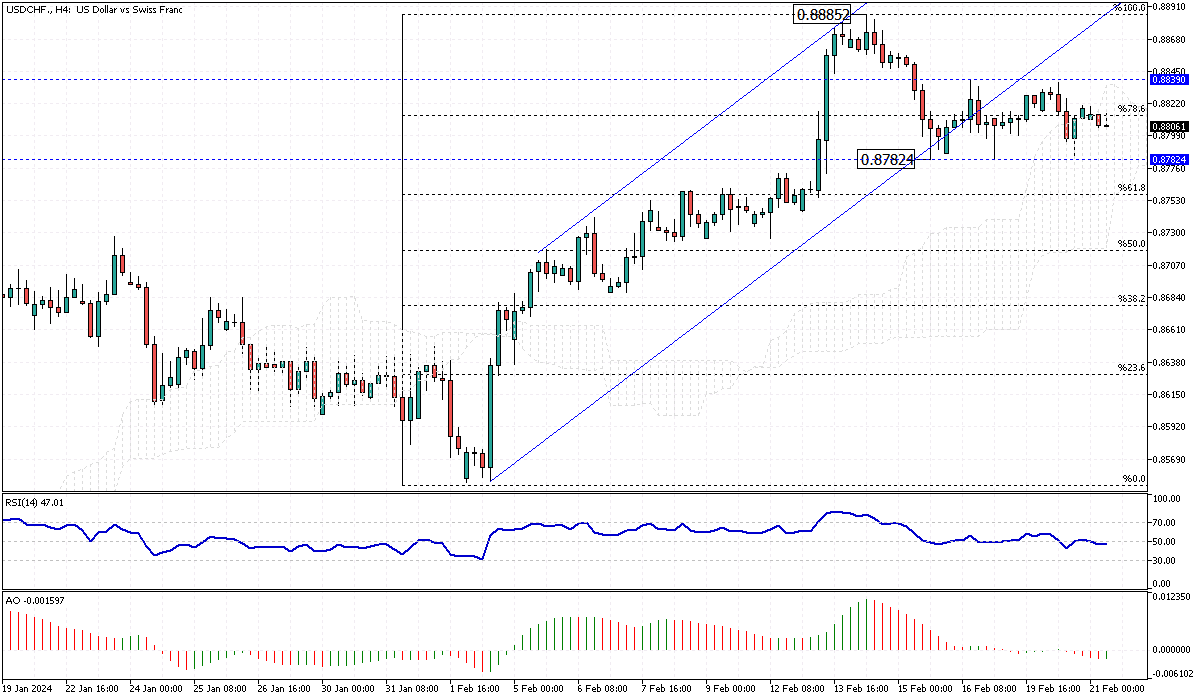

USDCHF Analysis – February-21-2024

The Swiss franc is trading near the 0.88 mark against the US dollar, closely approaching its three-month nadir of 0.89 on February 13th. This position reflects a divergence in the economic landscapes of Switzerland and the United States, which hints at potential shifts in their respective monetary policies. While the US economy shows differing signs, the Swiss economic indicators, especially inflation rates, suggest a unique trajectory.

This difference is crucial for traders and investors to monitor as it significantly influences investment strategies and currency market fluctuations.

USDCHF Analysis: Inflation Trends and Monetary Policy Implications

January’s inflation rate in Switzerland was 1.3%, falling short of the anticipated 1.7% and marking the lowest rate over two years. This continued trend of inflation rates staying beneath the Swiss National Bank’s (SNB) 2% upper target for the seventh month consecutively could lead to significant monetary policy adjustments. Analysts are now speculating that the SNB might reduce its benchmark policy rate sooner rather than later, potentially as early as March.

This anticipated adjustment is primarily due to the phased removal of electricity subsidies and modifications in the value-added tax system, which were expected to increase inflation figures but have not had the predicted effect.

External Factors Influencing the Franc

The SNB’s recent activity in the foreign exchange market adds to the pressure on the Swiss franc. The SNB has increased its foreign exchange reserves for two consecutive months as of January, a notable shift after two years of significant declines that brought the reserves to their lowest in seven years. This increase in reserves could signal the central bank’s proactive stance in managing the franc’s value on the global stage.

For investors and market watchers, this development is a critical indicator of the SNB’s future monetary policy directions and potential impacts on the franc’s performance against a basket of currencies.