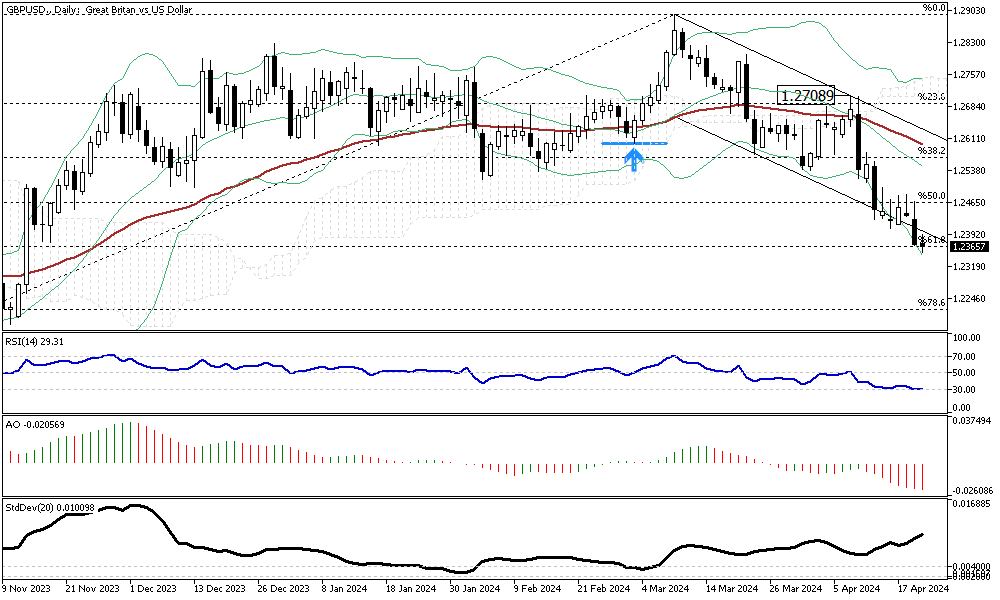

GBPUSD Stabilizes Amid Economic Uncertainty

GBPUSD Analysis – The British pound has found a temporary footing at $1.24, close to its lowest point since mid-November. This stability comes after underwhelming British retail sales figures and ongoing tensions in the Middle East kept investors on edge. Despite hopes for a robust recovery, UK retail trade remained flat in March, a clear indicator of faltering consumer confidence.

Economic Indicators Point to Cautious Outlook

Recent Office for National Statistics (ONS) data showed that while the UK’s inflation rate has dipped to 3.2%—the lowest since September 2021—it has not decreased as much as analysts had hoped. This persistent inflation underscores the British economy’s challenges, from sluggish consumer spending to ongoing price pressures in various sectors.

Central Bank’s Stance on Interest Rates

Amid these economic headwinds, Bank of England official Megan Greene warned against premature monetary easing. She highlighted that the current pace of wage growth and service sector inflation remains too high for the central bank to consider lowering interest rates. This stance suggests that the Bank of England is opting for a cautious approach, prioritizing the containment of inflation over stimulating growth.

Dollar’s Dominance Continues

On the other side of the Atlantic, the US dollar continues to exhibit strength, supported by the Federal Reserve’s hawkish stance. Federal Reserve officials have clarified that they are not ready to cut interest rates soon, reinforcing the dollar’s position against other major currencies, including the pound.